New growth drivers in place

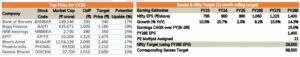

Sobha Ltd (SDL) delivered a sharp sequential recovery in Q4FY25 with presales of INR 18.4bn (+24.4% QoQ, +18.1% YoY) c.50% from its new launches, supported by robust traction in Bengaluru (INR 14.1bn; ~77% of sales), alongside improved performance in Gurgaon, Hyderabad, Tamil Nadu, and Kerala. SDL’s average realization for FY25 stood at INR 13,412/sf (+22.8% YoY), aided by a rising share of own land projects (~79% of FY25 sales). While Sobha missed its FY25 pre-sales guidance, this was primarily due to approval delays and slower-than-expected sales conversion in high ticket size products in Gurugram/Bengaluru. Steady traction was seen across other launches with ~45-50% sales velocity within 90days of launch. FY26 will be a year of major transition with (1) new geography addition in Noida, Pune and MMR (combined GDV of INR 40bn launches during FY26); (2) smaller single phases multiple launches with GDV of up to INR 15bn each; (3) improving approval scenario; and (4) robust net cash of INR 7bn to be topped up with INR 15bn+ annual CFO. Depletion of loss-making contractual order book and improving premium projects in revenue mix will result in significant profitability improvement. We expect presales momentum to sustain in the INR 90–100bn range for FY26, with upside possible if launch timelines and approval cycles further improve. SDL has laid out plans to expand in the MMR and Noida market from FY26, ramp up its presence in Pune and Gurugram, and consolidate in Bengaluru. Valuation comfort, robust FCF generation, and likely deleveraging are key near-term triggers for further rerating. Given the robust launch pipeline, strong balance sheet, and stable cash flows, we maintain BUY on SDL with a TP of INR 2,459/sh.

▪ FY26 to be different – diversified launches across geographies to de-risk sales: Sobha missed FY25 guidance of INR 85bn presales as some of the high-ticket launch conversion (Gurgaon and Crystal Meadows, Bengaluru) to sales has been slower and few large launches were multi-phased. FY26 will mark a shift towards geographic (MMR, Noida and Pune new addition) and product diversity, with Sobha planning 12–13msf of launches (INR 150bn GDV) across Bengaluru, MMR, Noida, Chennai, and Gurgaon, nearly 50% outside Bengaluru. In Gurgaon alone, the company has five new projects in the pipeline, with cumulative launch value of INR 100bn (~5msf), of which Phase 2 of Karma Lakelands and Sector 63A (1.55msf) are expected in FY26. Noida, Pune and MMR launches (INR 10bn, INR 10bn and INR 14bn respectively) will further add depth to the launches.

▪ Regulatory approvals back on track: With regulatory approvals now back on track, Sobha is poised to significantly ramp up its launch activity across key markets. The easing of approval delays—especially in select southern markets—provides better visibility on inventory monetization over the next 2–3 quarters. This recovery in the approval pipeline not only enables timely project launches but also supports improved cash flow generation. Coupled with strong collection efficiency and disciplined capex, SDL’s balance sheet remains healthy, with net debt levels under control, N/D at 0.13x, and adequate headroom to fund growth. As of Q4FY25, we expect SDL to have net cash status as rights 2nd call of INR 10bn came.

▪ Well- poised for growth: SDL is well-positioned to accelerate presales in FY26 (HSIE est. INR 94bn, 67% YoY growth), driven by 1) well-stocked launch pipeline in core markets (especially Bengaluru and NCR), 2) Healthy mix of plotted, mid-income, and premium projects, and 3) Continued pricing power supported by quality offerings and brand strength. While near-term margins may fluctuate due to product mix, higher self-owned land share and execution ramp-up should aid embedded profitability in FY26. SDL remains a strong play on the southern India premium housing market, with superior execution, brand recall, and improving balance sheet quality. Given its launch visibility, pricing resilience, and improving cash flows, we remain constructive on the name.