Acceleration in transformation to drive valuation

About the stock: South Indian Bank (SOUBAN) is old private sector bank based out of Kerala. The bank has undergone business transformation which has led to gradual improvement in business performance over past years.

• Distribution network with 948 branches & 1315 ATMs with strong presence in south India.

• Loan book at ₹ 77686 crore with ~36% book from Kerala. Diversified asset mix with corporate/ retail/ business/ agriculture segments contributing ~38%/ 23%/ 20%/ 19% in loan book

Q3FY24 performance: Healthy momentum in credit growth continued at 11% YoY & 4% QoQ to ₹75340 crore, led by corporate segment. New book stands at ~67% of total book. Deposit growth came at 9% YoY & 2% QoQ with CASA ratio at 31.8%. Treasury propelled earnings and RoA which came at 1.07%. Continued pressure on margins led to ~12 bps QoQ decline at 3.19%. Expenses included wage provision of ₹24 crore and one-time provisioning on fraud of ₹28.6 crore. Asset quality of new book remained resilient resulting in lower slippages at 0.34% & credit cost at 0.25%. GNPA/ NNPA ratio witnessed decline of ~22 bps/ 9 bps QoQ at 4.74%/ 1.61%.

Investment Rationale

• Focus on five areas to pedal transformation journey: Post restructuring, now the focus is on five-pronged strategy to steer growth and profitability. 1.) Focus to accelerate growth in MSME & retail portfolio through empowerment of branches to meet customer needs; 2.) improve branch productivity through increased training and improving “Tooth to Tail” ratio from 75:25 to 85:15; 3.) Acknowledging relatively higher CI ratio (~62% in Q3FY24), the bank is set to review employee and operating expenses; 4.) Focus on non-branch sourcing of business through partnerships; 5.) Enhance control & compliance architecture to ensure smooth business processes.

• Focus on retail & MSME segment to aid margins: Accelerating MSME & retail loans will aid margins, however, shift towards non-corporate segment could keep growth volatile. Expect advance growth at ~13% in FY24-26E with gradual uptick in proportion of MSME & retail loans. Healthy liabilities franchise, recent capital raising & scope to increase CD ratio is seen to keep margins steady at ~3.2-3.3% in FY24-26E. Further, resilience of new book (~67% of total advances) and run down in old book is seen to keep slippages and thus credit cost benign.

Rating and Target Price

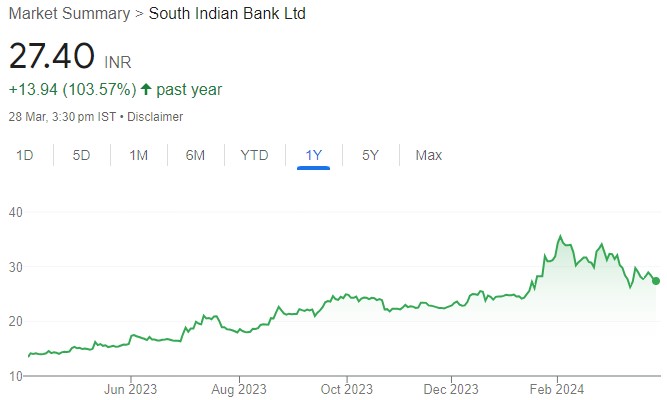

• With business transformation imbibed & new competitive leadership, current trajectory of business restructuring is expected to continue. Increased focus on retail & MSME segment to aid granularization and margins which is expected to drive RoA at ~0.9-1% ahead. Valuing the stock at 0.8x FY26E BV, we assign a target of ₹ 35 and recommend a BUY.