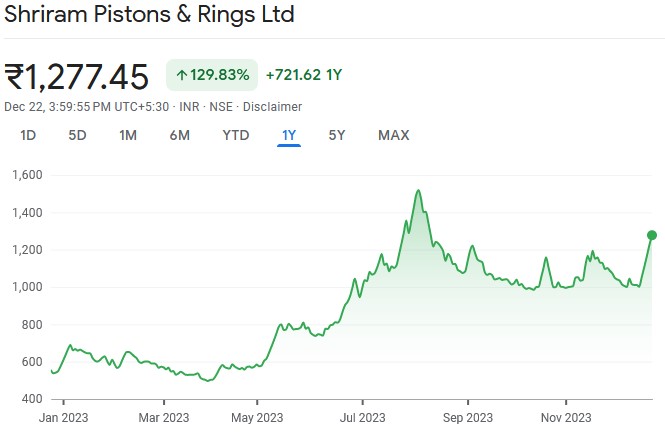

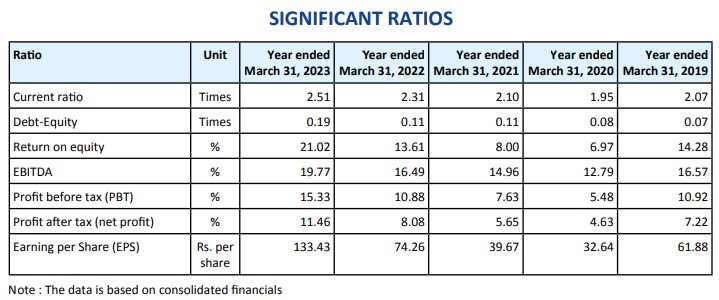

Sunil Singhania’s (Abakkus) purchase of 6.7% of Shriram Pistons appears to be because of its EV prospects. The Co is a small-cap with low free float. It is a market leader in piston rings and engine valves. It has low debt (0.19x), high RoE (21%) and high EBITDA margin (20%)

Overhang of large shareholder wanting to exit is over

Since November 2022, S Kolbenschmidt GmbH, a technology supplier to Shriram Pistons and a shareholder with 20.32% of the paid up equity share capital, had expressed its intention to sell the stock.

It sold 16.33% of its holding on December 20, 2023 in a Bulk Deal for Rs 430.4 crore. Its stake is now reduced to 3.99%.

Sunil Singhania’s Abakkus funds purchased 29.54 lakh equity shares or around 6.7 percent stake in the company at a price of Rs 1,103.6 per share on December 20.

AL Mehwar Commercial Investments bought 4.36 lakh shares at the same price.

| Type | DATE | CLIENT NAME | BUY / SELL | QUANTITY TRADED | TRADE PRICE / WHGT. AVG. PRICE |

REMARKS |

|---|---|---|---|---|---|---|

| BULK | 20-DEC-2023 | ABAKKUS GROWTH FUND – 1 | BUY | 4,54,550 | 1,103.60 | – |

| BULK | 20-DEC-2023 | ABAKKUS GROWTH FUND-2 | BUY | 3,63,630 | 1,103.60 | – |

| BULK | 20-DEC-2023 | ABAKKUS ASSET MANAGER LLP | BUY | 15,90,450 | 1,103.60 | – |

| BULK | 20-DEC-2023 | AL MEHWAR COMMERCIAL INVESTMENTS L.L.C. – (NOOSA) | BUY | 4,36,030 | 1,103.60 | – |

| BULK | 20-DEC-2023 | ABAKKUS EMERGING OPPORTUNITIES FUND – 1 | BUY | 5,45,450 | 1,103.60 | – |

| BULK | 20-DEC-2023 | K S KOLBENSCHMIDT GMBH | SELL | 39,00,000 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS ASSET MANAGER LLP | BUY | 15,90,450 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS DIVERSIFIED ALPHA FUND – 2 | BUY | 1,81,810 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS ASSET MANAGER LLP | BUY | 1,46,270 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS DIVERSIFIED ALPHA FUND | BUY | 1,81,810 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS EMERGING OPPORTUNITIES FUND – 1 | BUY | 5,45,450 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | AL MEHWAR COMMERCIAL INVESTMENTS L.L.C. – (NOOSA) | BUY | 4,36,030 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS GROWTH FUND-2 | BUY | 3,63,630 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | ABAKKUS GROWTH FUND – 1 | BUY | 4,54,550 | 1,103.60 | – |

| BLOCK | 20-DEC-2023 | K S KOLBENSCHMIDT GMBH | SELL | 39,00,000 | 1,103.60 | – |

Small-cap with low free float, market leader in piston rings and engine valves

Shriram Pistons & Rings is engaged in the manufacturing of pistons, piston pins, piston rings and engine valves for various automotive companies in the domestic and export markets. According to the corporate video, Shriram Pistons is the largest manufacturer and market leader in piston rings and engine valves in India. The largest supplier to OEM customers and the largest exporter of pistons and piston rings. It has collaboration with leading global technology Partners such as Corbin Smith of Germany and Ricken Corporation of Japan.

It is a small-cap with a market capitalisation of Rs 5700 crore and a free-float of Rs 1300 crore.

The promoters hold 46.75% of the equity. FIIs have a minor stake of 0.08% while the DIIs have 9.29%. The public holds 43.88%. The public holding is dominated by the large shareholders like KS KOLBENSCHMIDT, RIKEN CORPORATION and now Abakkus Funds and AL Mehwar.

Expansion into Electric Vehicle space

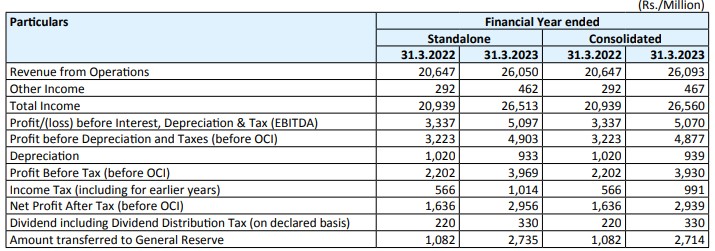

During the year 2022-23, Shriram Pistons witnessed growth in the Sales despite the challenges posed by geopolitical situation leading to multiple supply chain challenges.

Its’ revenue from operations grew by 26% from Rs. 20,647 Million (previous year) to Rs. 26,050 Million (during the year) and the total income increased by 27% from Rs. 20,939 Million (previous year) to Rs. 26,513 Million (during the year). Profit before Depreciation and Taxes [before Other Comprehensive Income (OCI)], after all interest charges but before depreciation and taxes, grew by 52% from Rs. 3,223 Million (previous year) to Rs. 4,903 Million for the year.

The improvement in performance was contributed by factors like increase in production & sales, increase in productivity, streamlining of the supply chain, digitization, focused approach to meet customer requirements, effective management of cash flow and implementation of cost optimization measures including effective utilization of resources.

Based on the strength of its financials, the Company is well positioned to invest in various avenues for overall growth of business. The Company has already done some strategic investment into technology growth areas through SPR Engenious Limited (wholly owned subsidiary) in EMF Innovations Private Limited, which is Singapore backed electric motor design & manufacturing company. The Board has approved acquisition of 75% stake in Takahata Precision India Private Limited which manufactures a wide range of products such as automotive parts, office automation equipment parts, optical equipment parts, residential facilities parts and medical equipment parts. The Company aims to expand its presence in Electric Vehicle space to supply Electric Powertrain Components such as Motor & Controller covering all the vehicle segments from Two Wheelers, Three Wheelers, Passenger Vehicles, Commercial Vehicles and Buses.

Key Business developments:

(1) Acquisition of 51% stake in EMF Innovations Private Limited (“EMFI”) The Company through its wholly owned subsidiary SPR Engenious Ltd. acquired 51% stake in the share capital (on a fully diluted basis) of EMFI for a total consideration of INR 780.03 Mn. EMFI is a Singapore backed electric motor design and manufacturing Company. EMFI is a young Technology company co-founded by engineering entrepreneurs with substantial R&D and operations in India and Singapore thereby providing localized cost effective e-mobility solutions to customers in India and abroad. EMFI has been leveraging on its strong power electronics & motors research base and extensive semi-automated manufacturing eco-system to deliver reliable EV Motors and Controllers for green mobility solutions and various other applications.

(2) Acquisition of 75% stake in Takahata Precision India Private Limited (TPIPL) The Company through its wholly owned subsidiary SPR Engenious Ltd. has acquired 75% stake in the share capital (on a fully diluted basis) of TPIPL at an Enterprise Value of INR 2,220 Mn. TPIPL’s existing portfolio of precision moulded parts, precision metal moulds parts, assembled parts having a variety of functional products for the automotive and other Industrial applications, fits into the Company’s strategy of inorganic growth alongside de-risking its current business model.

EVs dont require PISTON RINGS and VALVES. These are required for IC engine vehicles