Sustained strong performance across key operating metrics should drive a re-rating in the...

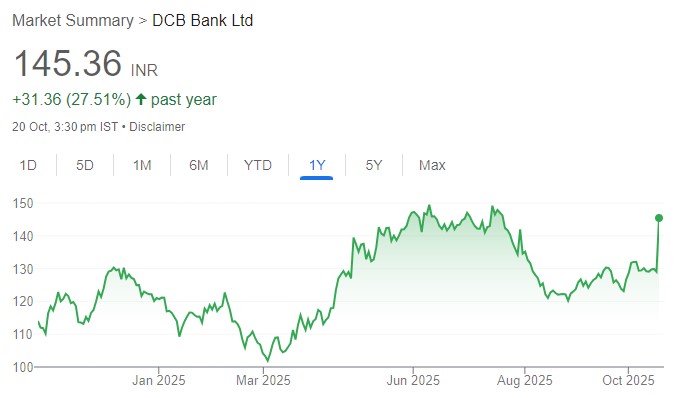

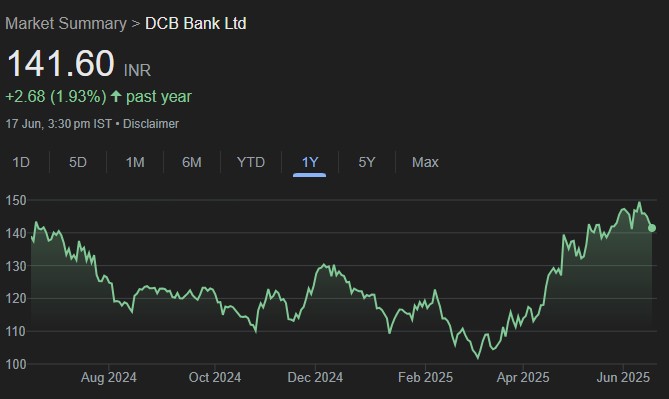

DCB Bank Ltd share price target

We met Mr Praveen Kutty, MD&CEO of DCB Bank (DCB). Highlights: 1) Management is...

We view DCB is set to deliver returns and could possibly become a 1%...