Capex of Rs 500 cr planned over 5 years

On the investment side, during the FY23, TCIEXP incurred a capex of Rs 125 crores, primarily spent towards the acquisition of land for setting up new automated sorting center in Kolkata and Ahmedabad and for new corporate office in Gurgaon. Capex incurred during FY23 at Rs 125 cr, primarily spent towards land acquisition for setting up new automated sorting center in Kolkata and Ahmedabad and for new corporate office in Gurgaon. Capex of Rs. 46 cr incurred during FY24 primarily spent towards expansion of branch network, Automation and construction of new sorting centres.

TCIEXP will invest about Rs 500 cr over the next five years (FY23-28) to quadruple its sorting centre capacity and towards automation and enhancing technological capabilities. This capex will be funded entirely from internal accruals; nonetheless, the company is expected to generate positive FCF. We believe this scale of capacity expansion will cater to TCIEXP’s demand needs for the next eight–ten years, which should help it generate high FCF after the capex phase is over.

The company achieved full automation at pune sorting centre (similar to Gurgaon), delivering 40% turnaround time reduction and enhanced operational efficiency with AI-enabled technology. This will further enhance our operational efficiencies and margins in the forthcoming quarters.

Strong cash flow

There was strong cash flow from operation of Rs. 130 crores with robust CFO to EBITDA ratio of 70% in FY24. TCIEXP also had strong cash flow from operations (CFO) for FY23 at Rs 153 crore. Company continues to maintain strong CFO to EBITDA ratio of over 65%, which provides extensive flexibility the company continue to focus on balanced capital allocation. TCIEXP has efficient working capital management with robust capital structure and strong cash flow conversion cycle.

Leading player, strong growth history

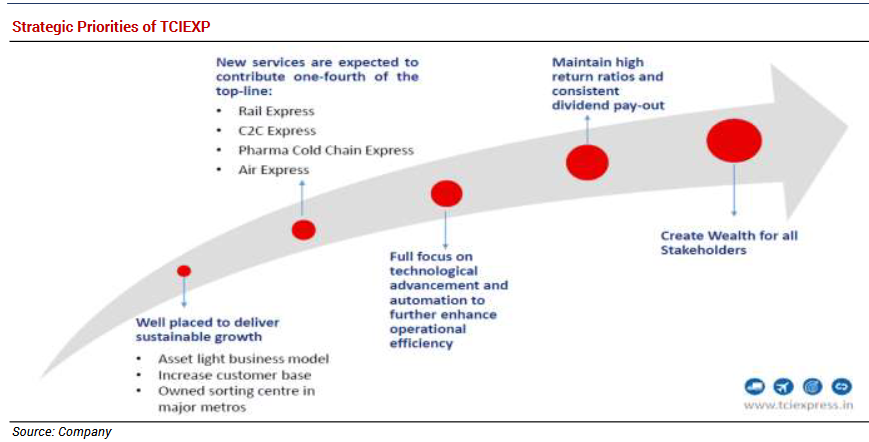

TCI express is leading ground express player with the company claiming to have a market share of ~7%. In CY16, Transport Corporation of India (TCI) completed the de-merger of its express division and over FY17 to FY23, despite Covid TCIEXP reported revenue CAGR of 6.2% and earnings CAGR of 21.2% with high return ratios. Q3 print was weak on expected lines and in line with industry trends. Company expects partial recovery in FY25 and full recovery in FY26. Going forward, we expect ecommerce, manufacturing and MSMEs to be the key demand drivers, while technology and logistical infrastructure will be key enablers for market expansion.

Valuation and outlook

TCIEXP has delivered an impressive well-rounded performance (volume-led, marginally ahead-of-the-industry growth + cost saving and improvement in operating margins) over the past six years and emerged as a credible player in Express Industry. Company claims to have a market share of 7% in express industry. Q2FY24 performance looks weak considering the upcoming festive season in Oct and November. However, management is confident of improvement in performance in future quarters. More sorting centers, new branches and new services like rail express will drive the top line and margins in the forthcoming quarters. Company claims to have a market share of 7% in express industry.

More sorting centers, new branches and new services like rail express will drive the top line and margins in the forthcoming quarters. Company claims to have a market share of 7% in express industry. Performance looks weak considering improved performance of Bluedart in Q4. Management is confident of improvement in performance in future quarters. More sorting centers, new branches and new services like rail express will drive the top line and margins in the forthcoming quarters. Company claims to have a market share of 7% in express industry. We expect TCIEXP to report revenue and earnings CAGR of 10.5%/13.5% respectively over FY25 to FY26E, with improvement in operating margins and healthy return ratios and continue to recommend BUY on TCIEXP with a reduced TP of Rs 1490 (from Rs 1720) at 33x FY26E

Click here to download TCI Express – Q4FY24 Result Update – 13 May 2024 by Kotak Securities