Macro & Earnings Continue to Drive the Near-Term Market Direction

The Axis Top Picks Basket delivered a return of 11.6% in the last six months against the 7.5% returns posted by Nifty 50 over the same period. Amidst a highly volatile month of Oct’24 that witnessed notably mixed performance across sectors, market caps, and style indices, the Axis Top Picks basket declined by 4.4% in Oct’24 (Till 1st Nov’24 closing) but managed to beat the market performance as the benchmark Nifty 50 declined by 5.8% over the same period. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 329% since its inception (May’20), which stands well above the 162% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection. FY25 – Good Start but Volatile Path Ahead; Macro to Remain at the Centre: Nifty reached an all-time high of 26,216 on 26th Sep’24. The market has seen a 7-8% correction since then and now 54% of NSE 500 stocks are trading above the 200-day moving average vs 77% stocks on 26th Sep’24. The correction in the last one month was largely led by 1) FII selling, 2) Increase in bond yields, 3) Expectations of China recovery, 4) Muted Q2FY25 earnings, and 5) Higher valuation after the run-up. Over this same period, FIIs sold $11.9 Bn in the Indian equity market while DIIs bought $13.6 Bn. Moreover, in FY25 so far, FII pulled out $1 Bn, while DIIs have invested a massive amount of $41 Bn in the Indian equity market.

We Maintain our Mar’25 Nifty Target at 24600

Base case: In our Dec’23 Top Picks report, we upgraded the Dec’24 Nifty target to 23,000 with an upside potential of 14% from the Nov’23 closing. We are happy to say that we have successfully achieved the target well before the time. This indicates our confidence in the current macroeconomic cycle and the earnings growth. We continue to believe that, the Indian economy stands at the sweet spot of growth and remains the land of stability against the backdrop of a volatile global economy. We continue to believe in its long-term growth story, driven by the country’s favourable structure, thanks to the increasing Capex which is enabling banks to improve credit growth. This will ensure that Indian equities will easily manage to deliver double-digit returns in the next 2-3 years, supported by double-digit earnings growth. Against this backdrop, we foresee Nifty earnings to post excellent growth of 16% CAGR over FY23-26. Financials will remain the biggest contributors for FY25/26 earnings.

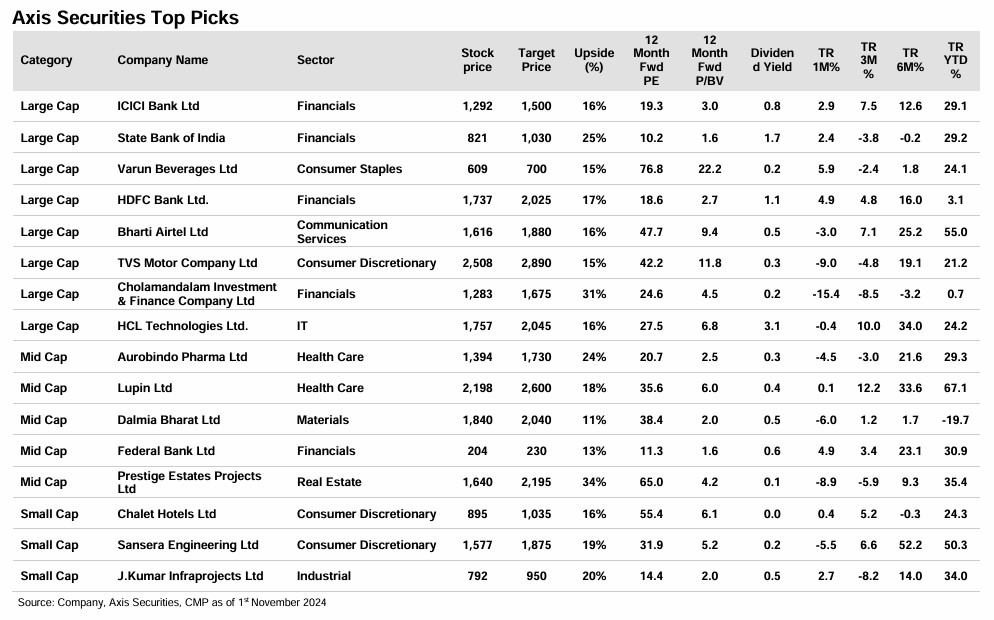

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank, Dalmia Bharat, State Bank of India, HCL Tech, Lupin, Aurobindo Pharma, Federal Bank, Varun Beverages, TVS Motors, Bharti Airtel, Chalet Hotel, J Kumar Infra, Prestige Estates, Sansera Engineering, and Cholamandalam Invest and Finance