In the midst of an upcycle!

The hotel industry is continuing its healthy performance, led by favorable demand-supply dynamics, which are expected to continue in the foreseeable future. All the major players are harnessing their strength to tap into the ongoing uptrend in the hotel industry. In this report, we highlight the industry tailwinds and unique positioning of key players.

Long-term growth story intact: We expect the uptrend in the hotel industry to continue as demand for branded rooms (~10.6% CAGR over FY24-27) is expected to outpace supply (~8% CAGR), led by multiple industry tailwinds. The gap is even wider for top-8 cities and the leisure market. Further, supply growth is even lower in the luxury/upper upscale segments (~5/7% CAGR over FY23-27), leading to better pricing power for premium players.

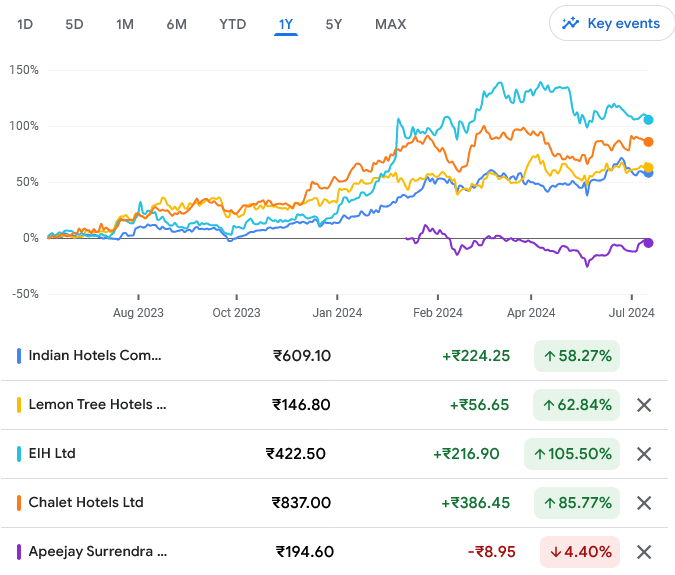

Interestingly, all the key players are positioned differently to tap into this opportunity. The brand owners (Indian Hotels, Lemon Tree, EIH and The Park) are much more focused on management hotels and revenue diversification, along with the addition of some owned hotels. Meanwhile, the asset owners (Chalet, Samhi and Juniper) are strongly focused on leveraging the growth by adding more owned keys.

Outlook: Key listed hotel companies witnessed healthy performance in 4Q, with EIH outperforming peers. Going ahead, we expect 1QFY25 to be relatively muted on account of elections and severe heatwaves in North India. However, we believe that the medium- to long-term outlook remains optimistic.

Valuation and view: Improvement in ARR and occupancy, incremental inventory to drive growth ahead

Occupancy and ARR are expected to continue to trend higher in FY25, backed by favorable demand-supply dynamics. The industry is witnessing strong demand drivers, such as buoyant economic activities, new convention centers, improved connectivity, recovery in FTA, and rising trends such as spiritual/wildlife tourism.

We anticipate earnings growth for hotel companies to remain intact in FY25/FY26, aided by: 1) an increase in ARR across hotels, due to a favorable demand-supply scenario, corporate rate hikes and room upgrades through renovations; and 2) heathy operating leverage.

We reiterate our BUY rating on IH (TP of INR680) and LEMONTRE (TP of INR175) for FY25.