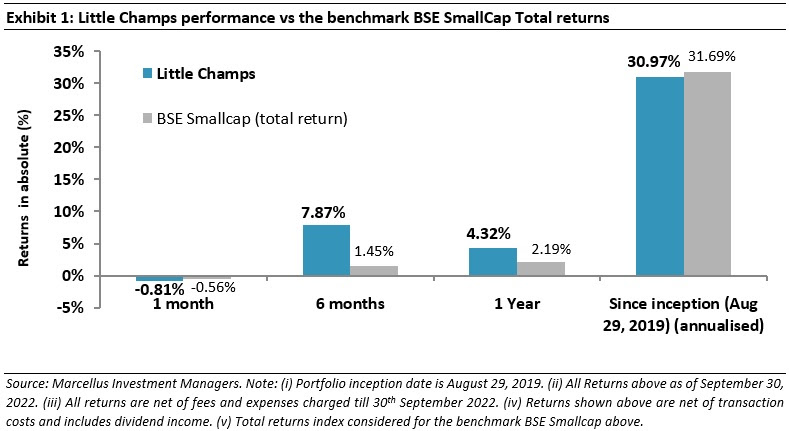

Little Champs are resilient & have delivered annualized return of 30.97%

Saurabh Mukherjea‘s Team Marcellus has issued a detailed note explaining the impact of the ongoing global turmoil on the prospects of the stocks in the Little Champs portfolio.

First, it may be noted that the Little Champs have put up a spirited performance with an impressive annualized return of 30.97% since 29th August 2019. This is almost on par with the return of 31.69% given by the BSE Smallcap Index in the same period.

The chosen stocks are sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. Companies with where there is doubt about the cleanliness of accounts or the integrity of the promoters are avoided.

Globalisation is a key growth driver for 8 Little Champs stocks

Team Marcellus has identified 8 stocks in the portfolio which have used globalisation as a growth strategy by replicating their domestic success factors (across products, process and people) on a global canvass. These eight companies have sizeable exposure to the global/exports business and are the following:

Globalisation is a key growth driver for a number of Little Champs companies

| Company | % Revenue from outside India (FY22) | Remarks |

| Garware Technical |

65% | Exports revenue share up from 44% in FY12 to 65% in FY22 thanks to breakthrough success in Salmon aquaculture where Garware has emerged as the leading net (cage) supplier in key geographies like Canada, Scotland, Norway and Chile. |

| GMM Pfaudler | 72% | GMM has been for long the domestic leader in the supply of glass lined equipment (GLE) in India. The Company recently acquired the global business of its parent Pfaudler which makes the combined entity the dominant player in the global GLE industry. |

| Ultramarine & Pigments | 24% | Ultramarine is among the top 3 suppliers globally of niche inorganic ultramarine blue pigments that find applications in plastic masterbatches, paints, ink, laundry etc. Exports account for >60% of the pigment division sales with a diversified geographical presence across USA, Europe, East Asia etc. |

| Galaxy Surfactants | 64% | Galaxy is the leading oleochemical based surfactants supplier in India focussing on the home and personal care segment. Over the last decade, Galaxy has also built a strong global franchise (now derives nearly 2/3rd of its revenues from outside India) through new plant in Egypt (to cater to Africa, the Middle East and Turkey markets) and acquisition of Tri-K Industries Inc, a US based company focussing on specialty care products. |

| Suprajit | 40% | Through organic and inorganic routes over the last decade, Suprajit Engineering now has 40% of its revenues from outside India. The company has built market leading global franchises in automotive cables (a top 5 global player) and automotive halogen bulbs (top 3 globally). With the recent LDC acquisition, contribution of ex-India sales is likely to be greater than 50%. |

| Fine Organic | 60% | Fine is by far the largest producer of oleo-chemical based food, polymer Industries and certain specialty additives in India and amongst the leading players globally with exports contributing “60% of revenues. The Company has built a strong franchise in polymer additives globally and more particularly in slip additives where it has emerged a global market leader. |

| Tarsons | 33% | Over the past decade, Tarsons has successfully replicated its domestic Products competitive advantage in the global market, i.e., its USP to sell high quality products at lower price points. Given the size of the Global Plastic Labware industry (USS) 8.4bn, Tarsons has a long growth runway. |

| Alkyl Amines | 17% | Through constant capacity expansions and being one of the lowest cost producers globally, Alkyl ranks amongst the top 3 global players in some of its products like Acetonitrile, DMA HCL, etc. |

It is pointed out that though the near-term scenario for export/global markets is uncertain, there is confidence about the medium to longer term prospects for the global businesses of Little Champs.

Essential end-user Industries

One of the important points is that the products sold by the majority of export oriented Little Champs cater to essential end-user Industries like pharma, food, etc which tend to have resilient demand even at times of recession.

One prime example is Garware which generates 70% of its total revenue from food related industries like Salmon Aquaculture, Agriculture, Fishing, etc. Similarly, Fine Organics also derives a significant portion of its revenue from Food related industries. Alkyl Amines and GMM Pfaudler generate a lion’s share of their revenue from pharmaceuticals and chemicals industry. Likewise, Tarsons generates 60% of its revenue from Diagnostic Labs and Pharmaceuticals industry. Galaxy Surfactants is also a good example because it largely caters only to the Home & Personal Care industry.

Strong balance sheets and a diversified revenue base

Team Marcellus has also emphasized the point that the Little Champs have strong balance sheets and a diversified revenue base. While their non-India revenues may be impacted in the short term, these companies have a thriving domestic business which can provide support (profits and cash flows) to the overall business.

It is also noteworthy that most Little Champs have surplus cash sitting on the balance sheet which places them in an advantageous position and enables them to continue investing in products, processes, and people.

Little Champs will gain market share

Thereafter, Team Marcellus has expressed confidence that the Little Champs stocks can deal with the prevalent headwinds. In fact, the locational advantages in manufacturing alongside strong balance sheets, a thriving domestic business and ramp-up in investments in recent years to facilitate market share gains for the Little Champs, it is emphasized.