US generic growth to stay, selective on structural play

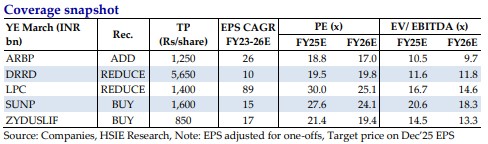

The pharmaceutical sector, emerging from the volatility of the past two post pandemic and geopolitically tumultuous years, is now on a recovery path in CY23. Overall costs are stabilizing and there are green shoots in the US business. This positive momentum has led to the BSE Healthcare index outperforming the Sensex by ~15/25% in the past 6/12 months. We remain constructive on US generics, led by factors such as moderating price erosion and regulatory issues (USFDA) in the US, successful approval and launches of complex products, opportunities arising from the loss of exclusivity, softening input costs, volume growth due to drug shortages, and steady growth in India. In light of these factors, we initiate coverage with a BUY rating for SUNP (TP of Rs 1,600) and ZYDUSLIF (TP of Rs 850), ADD for ARBP (TP of Rs 1,250), and REDUCE on LPC (TP of Rs 1,400) and DRRD (TP of Rs 5,650).

Visible green shoots in the US generics market: We see the US generics maintaining steady growth momentum on moderating price erosion amid lower competition, drug shortage-led volume growth, USFDA clearances for key plants, and generic launches. Also, traction from key products (like gRevlimid, gSpiriva) provides visibility of nearto-mid-term growth. More so, the LOE-led opportunity of USD 100+ bn over the next five years could drive growth for generic companies.

Specialty and complex portfolio for long-term growth: The shift in focus towards specialty business will create differentiating pipelines targeting chronic and niche therapies. While we note that SUNP has already cracked the code for specialty business with its key specialty products (Ilumya, Winlevi, and Cequa among them), other companies like ZYDUS (saroglitazar), ARBP (CMO – biosimilars, peptides), DRRD (biosimilars, cell gene therapy), and LPC (partnered products like MALT1, injectables, biosimilars) are also on the path to create specialty franchises.

Steady domestic formulation growth: Despite various disruptions (GST, NLEM, Covid), IPM has seen steady ~10% growth in the last 10 years, led by steady volume and price (3-year CAGR at ~10% and 9MFY24 growth at 8% YoY, as per IQVIA). We believe domestic formulations will see steady growth led by volume recovery, price growth, and new launches. Leading companies (SUNP, LPC) could outperform IPM.

Improving profitability to strengthen balance sheet: Spike in cost structure (started in Sep’21—input costs, supply chain disruptions, inflation) had hit profitability in FY23. But costs have started to moderate in the past few months (correction in crude oil, freight) and the scale-up in US generics lifted margins in H1FY24. We see profitability remaining stable and improving in the near term. With healthy balance sheets, leading companies are looking for M&As (specialty assets, fill portfolio gaps). Outlook and valuation: We are positive on the US growth for the next few years on visible green shoots (new launches, moderating price erosion, and LOE). However, the outperformance of the BSEHC index vs Sensex which led to index valuation at ~30x (+2 standard deviation) provides limited scope for further rerating. Hence, we are cautious about valuations and see some structural and near-term opportunities. For structural growth, we initiate coverage with a BUY for SUNP on steady growth led by scale-up in specialty and ZYDUSLIF with visibility of US growth/R&D allocation for niche pipeline. For near-term performance, we initiate coverage with an ADD for ARBP, expecting growth in the US market and margin improvement. We initiate coverage with REDUCE stance on LPC as key triggers are factored-in and on DRRD due to constraints on growth/margin in core business (excluding gRevlimid).

Click here to download Pharmaceuticals Sector report Jan24 by HDFC Securities