There is no doubt FIIs will make a comeback in a big way in 2024

“I have no doubt there will be very big money coming into Indian markets,” Vikas Khemani said. He explained that FII flow is very directly linked to the interest rates going up and down in the US. There was a lot of outflow when the interest rates were going up. Last year, interest rates peaked out and hence there was not much outflow. However, for inflow to come, interest rates will have to come down. The Fed has indicated that two or three rates cut might happen in calendar 24. That sets the pace for or the direction for FII flows to come.

Khemani also pointed out that he has the fundamental belief that India is one of the most promising markets in the world but is significantly underrepresented in global portfolios. Both these trends would get corrected as the cycle turns and in the next couple of years, including calendar 24, India will continue to see massive flow coming from FIIs.

Senco Gold is a fantastic company

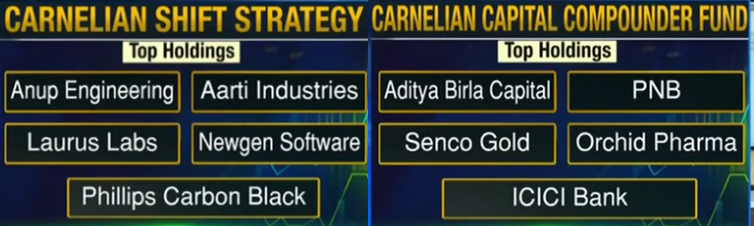

Vikas Khemani revealed that his Fund is invested in Senco Gold and he regards it as a “fantastic company”. It was very underpriced at around 20 PE around the IPO when there were not many takers and his Fund has been holding since then. He stated that he has no view on the jewellery or the consumption sector and that his bullishness is confined to Senco Gold. “We have not bought many consumer stocks in the last four or five years, but whenever we find an interesting, credible story, available at a reasonable price, we would definitely buy,” he added.

It is worth recalling at this stage that Prashant Jain’s 3P Fund is also invested in Senco Gold. SBI Securities has described the company as a “Sparkling gem at attractive valuation” with great growth prospects. It says the business model is robust with right mix of CO/Franchise. Margins & return ratios are healthy. SBI Sec has recommended a buy for the Target Price of Rs 920.

Big money is to be made in Pharma stocks

Vikas Khemani advised investors not to buy pharma because it is a defensive but to buy it because it is a growing sector.

“Pharma was not going anywhere in the last seven, eight years, except for the last one year or so. We think that the seven-year cycle is over. We are beginning to see a very interesting trend developing in the segment, both from a US market perspective, as well as the domestic market perspective. The US markets are getting better and are expected to get even better. We think the underperformance of seven, eight years will catch up. We think that is where big money can be made,” he said.

He also said that there is opportunity all across the largecap and midcap pharma stocks and investors have to look at the business model and decide.

“Pharma is a very wide name, but each pharma company has a very different business model, different focus and one has to see each individual company very differently. You really cannot paint the sector with a broad brush. It is really bottom-up and there is a value and opportunity across the spectrum, largecap and smallcap and midcap, but it depends. We like the CDMO space. We like domestic pharma. We like companies which export to US markets and have a dominant position there. We like companies which have specific new products coming and beginning to fire. You really cannot have one approach in pharma. Each company is kind of very unique in that sense,” he added.

HDFC Bank’s underperformance will continue and it may get derated. Buy PSU Banks

Vikas Khemani disclosed that his Fund had never bought HDFC Bank because he believed that it might get de-rated. “It is a fantastic bank, there is no question on that. But it is going through its own transitionary period, so might see some more underperformance continuing,” he said.

He opined that a big transformation is happening in PSU stocks and PSU bank as a basket would outperform the private sector bank. “I have no doubt that banking as a segment will do well because there is no way India can get built or India can grow without growth in credit and large private sector banks. The entire banking basket will do well. But from a medium-term perspective, PSU banks might deliver better returns”.