Increasing localisation to drive growth…

About the stock: Timken India Ltd is engaged in the manufacturing, distribution and sale of anti-friction bearings, components, accessories and mechanical power transmission products for the customer base across different sectors

• FY23 revenue mix: Railways ~15%, Mobility ~21%, Process Industries ~15%, Exports ~27% and After-market & others ~16%

• Consolidated revenue of the company has grown by 20.2% CAGR during the period FY20-23 while EBITDA and PAT have grown by 15.5% and 16.7% CAGR respectively over the same period

Investment Rationale:

• Demand remains strong from key domestic segments: Timken India has been witnessing strong demand from its key domestic segments like railways (including both freight and passenger), process industries (like cement, steel, renewable power etc), led by buoyant capex scenario. Company derives ~30% of its revenues each from these two segments. The company is already a leading player in Indian railway freight segment with a market share of more than 50%. Going ahead, company is focused on further gaining market share in these segments led by new technology (like sealing solutions). Moreover, exports (~27% of total) has also been healthy in railways segment (~50% of total exports). Company also expect pick-up in demand from mobility segment (which includes MHCVs and offhighways) in the coming period

• Commissioning of new capacity to aid further growth in domestic segments and exports: With the commissioning of new plant at Baruch, company would be able to increase production of spherical roller bearings (SRBs) and cylindrical roller bearings (CRBs) substantially, which would help company in increasing localisation of products for industrial segments like cement, mining, power, paper, metals etc (current company meeting demand through importing from parent Timken). Moreover, with increasing localisation, company is focused on increasing its share in industrial after-market segment (which is growing relatively better than auto after-market) and exports with more product offerings and expanding reach into new geographies and Target Price

• We believe that Timken India is strongly positioned to benefit from the buoyant capex outlay in its key domestic segments including railways and process industries. Increase in manufacturing capacity would help increasing localisation of products and further growth in both domestic markets and exports. We estimate revenue, EBITDA and PAT to grow at ~15%, ~22% and ~23% CAGR respectively over FY24E-26E

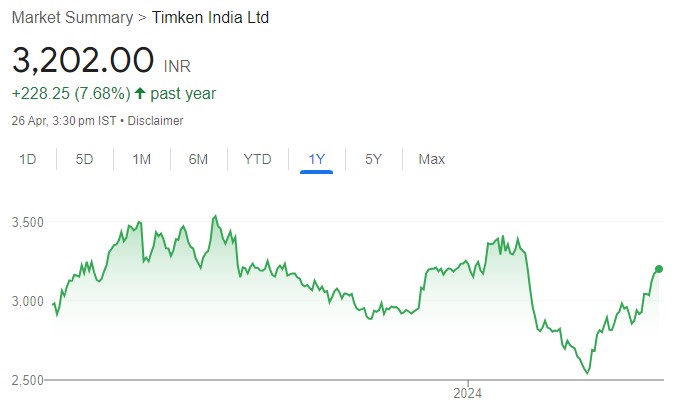

• We maintain our BUY on Timken India with a target price of ₹ 3950 per share (based on 55x FY26E EPS)