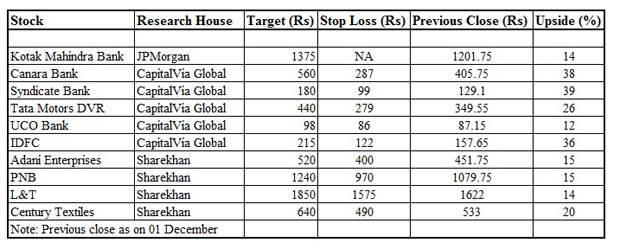

Kshitij Anand has spoken to leading experts like Nilesh Shah, MD & CEO, Axis Capital, Avinnash Gorakssakar, Head of Research, Miintdirect.com, Vivek Gupta, CMT – Director Research, CapitalVia Global Research and Gaurav S. Ratnaparkhi, Technical Analyst at Sharekhan. He has also collated the opinions of leading brokerages about what rate sensitive stocks investors can buy now.

Kotak Mahindra Bank: JPMorgan maintains ‘overweight’ with a target price of Rs 1375

JP Morgan has retained ‘overweight’ on Kotak Mahindra Bank. ING Vysya Bank’s acquisition is accretive for it. The acquisition also addresses key concerns, such as its narrow customer base and the need for promoter dilution.

Canara Bank: Target price Rs 560

Canara Bank is trading near the resistance mark of Rs 422 from the last few weeks and it is sustaining above its 50 and 200 DMA with the RSI of 56. The stock is likely to continue its recovery trend above the resistance level of Rs 422. One can expect the targets of Rs 557-560 with a stop loss of Rs 287.

Syndicate Bank: Target price Rs 180

The stock has shown correction from the higher levels and now it is accumulating below the resistance level of 134. The stock is trading above its 200 and 50 DMA with the RSI of 53. Therefore in near term buying opportunities can be seen in the stock with the crossing of the resistance level. One can expect targets of 170-180 in the stock with a stop loss of 99.

Tata Motors DVR: Target price Rs 440

It is in a bullish trend and has started showing recovery after the recent corrective movement from the higher levels. It is sustaining above its 50 and 200 DMA with the RSI of 61. It is likely to continue its northwards journey if it manages to sustain above the level of 279. One can expect the targets of 430-440 in the stock with a stop loss of 279.

UCO Bank: Target price Rs 98

For long term, UCO Bank is looking bullish on charts. Its technicals are indicating a strong bullish move in near team. The stock has well tested its falling trendline and is sustaining above its 200 & 50 days moving average. Traders can go for buying in this stock if the level of Rs 90.25 is crossed for targets of Rs 98 and above with a strict stop loss at Rs 86.

IDFC: Target price Rs 215

The stock is trading in a range and is sustaining above its 200 and 50 DMA with RSI of 62. If the stock breaks the range at the level of 167 and manages to sustain above the level of 122, the stock is likely to show a rally and may test the level of 212-215.

Adani Enterprises Ltd: Target price Rs 520

The stock has formed a multi week bullish triangular pattern. Currently it is trading near lower end of the pattern. Junction of 40 WEMA & weekly lower Bollinger Band is there to provide support. Thus one can buy the stock in the range of 445-435 with a stop loss of 400 for targets of 500 – 520

Punjab National Bank: Target price Rs 1240

PNB has recently started rallying from its crucial daily as well as weekly Moving Averages. Structurally it has started a fresh rally. Momentum indicators on various time frames are in line with the rally. One can buy PNB in the range of 1080-1060 with a stop loss of 970 for targets of 1200-1240

L&T: Target price Rs 1850

For the last few weeks L&T has been consolidating above multiple supports. Structurally the consolidation is likely to break out on the upside.

Medium-term momentum indicators are in a bullish mode whereas the short-term momentum indicators seem to have completed their correction cycle. One can buy L&T above 1657 with a stop loss of 1575 for targets of 1776 – 1850

Century Textiles: Target price Rs 640

The stock is finding support near 61.8% retracement of the previous Impulse on the upside. From the key Fibonacci ratio, it can start a fresh move on the upside. The stock can also witness lower Bollinger reversal from the current level on the daily chart. One can buy the stock in the range of 540 – 525 with a stop loss of 490 for targets of 600 – 640.

Please add me in the mailing list