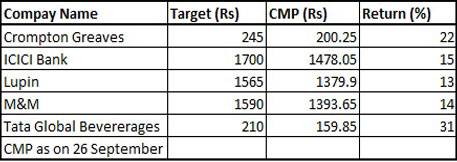

In his interview to ETNow, Jayant Manglik advised investors to invest in the following five stocks:

Crompton Greaves: Target 245

Crompton Greaves, with its plans for demerging and listing its consumer products business, will do well. It is doing well in its engines supply business.

ICICI Bank: Target: Rs 1700

ICICI Bank has always been a street favourite and has consistently delivered in terms of profitability and growth. It will be helped along with higher GDP growth, productivity gains, higher NIMs and better asset quality.

Lupin: Target: 1565

Lupin is the preferred choice in the pharma sector with 40% of its revenues coming from the US and a launch rate of 20 products a year. They also continue to expand to other countries and have a strong product pipeline’

M&M: Target: 1590

M&M is doing well in the tractor segment. It has aggressive product expansion plans.

Tata Global Beverages: Target: Rs 210

Tata Global Beverages Ltd. (TGBL) has a portfolio of brands in tea, coffee and water across 40 countries. It is focusing on expanding the range and strengthening the presence of its flagship brands i.e. Tetley, Tata Tea and Eight O’clock coffee. The joint ventures with PepsiCo and Starbucks open up potential markets.

Jayant Manglik advised investors to avoid timing the markets and instead to invest through a Systematic Investment Plan. He also said that since the March 2015 target for the BSE Sensex is 32,000, there is a lot of potential for gains left. He explained that the Sensex is currently trading at 18.3 times its trailing earnings, which is a 13 per cent premium to its historical 20-year average trailing PE of 16.3 (x). On similar occasions earlier, the markets peaked at 24 times forward earnings. So there is still a lot of headroom for PE expansion. As always, a lot will depend on policy delivery and its effective implementation because expectations are high and must be met for sustained market growth

Jayant Manglik also suggested that investors should have a mix of large-cap blue chips, mid-caps and small caps in the portfolio. “A good stock can be invested in at any time as long as the investment horizon is long-term” he said.

“Bluechips should be part of every investor’s portfolio and the best way to invest is a monthly systematic investment program” he added.