Leveraged Financials

The liquidity conundrum

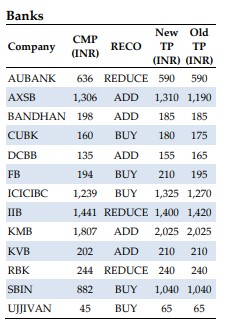

Given the rising competitive intensity for low-cost and granular deposits facing the banking system, loan-deposit ratios at historical highs, and expected rate cuts towards the back-end of FY25, we believe banks are faced with the challenge of quality deposit mobilisation, elevated funding costs (lagged deposit re-pricing) and softer incremental spreads. As banks and NBFCs navigate the growth-margin trade-off, we argue that the combination of lower growth and lower spreads is likely to keep valuations under check, especially of mid-sized, high-growth franchises. While we expect system-wide growth to decelerate by 90-100 bps from FY24 levels, we are conservative on incremental spreads across our coverage universe, pencilling in 50bps of rate cuts starting Q4FY25 (blended FY25 NIMs at 12-15bps below FY24). Our hypothesis remains anchored around strong retail deposit franchises and declining spreads over the next 12 months, coupled with the normalisation of credit costs. Our top picks are ICICIBC (BUY, TP: INR 1,325), SBIN (BUY, TP: INR 1,040), and KMB (BUY, TP: INR 2,025) among large banks.

Banks – envisaging rate cut impact starting H2FY25: With the share of EBLRlinked loans in total outstanding floating rate loans at ~60% as of Mar-24, banks are likely to witness sharp monetary transmission on the lending side once the rate cycle turns. However, given the typical maturity profile of contracted term deposits at 1-3 years, deposit re-pricing is likely to lag, as was observed during the rate upcycle (when loans re-priced faster than deposits). We opine this re-pricing mismatch is likely to reflect in incrementally declining spreads for banks. Also, with the likely upward normalisation in credit costs and the sustained pressure on opex intensity, we expect blended RoAs to decline by 5-10 bps in FY25/26 for our coverage universe.

NBFCs – the tug of war on funding costs: NBFCs had benefitted from credit substitution (away from bonds towards bank lending) during the early part of FY24, given that a large proportion of the bank borrowing was anchored to MCLR pricing. Compared to the steep rise in 1y, 3y and 5y spreads over the corresponding G-sec tenor paper, banks have hiked their 1y MCLR only by 167bps between May-22 and Feb-24. However, given the RBI’s repeated nudge to NBFCs to reduce incremental dependence on bank borrowings, the bank channel for funding is relatively less active. Also, given relatively softer accretion in the debt mutual fund AUM, bond spreads across maturity and rating buckets have widened relative to the Mar-24 quarter.

Key changes to our operating variable assumptions: Given the historically high loan-to-deposit ratio (across the banking system) and the RBI’s frequent flagging of growth in unsecured consumer credit, we envisage deceleration in system-wide loan growth trends from current levels. Assuming a rate cut of 50 bps (impact spreading over 2-3 quarters) starting in Q4FY25, the realtime pass-through on lending rates will have implications for margins with deposit re-pricing happening with a lag. NIMs are likely to drift incrementally lower during FY25 (NIMs for FY25 at 12-15bps below FY24).

Investment implications: We reiterate our conviction on banks with a strong balance sheet and formidable retail deposit franchise, which are likely to continue gaining market share, with ICICIBC (BUY, TP: INR 1,325), SBIN (BUY, TP: INR 1,040), and KMB (BUY, TP: INR 2,025) being our top picks amongst large banks.