PSBs have made a sharp comeback in recent years, with the Nifty PSU Bank Index alone delivering 162% returns since Mar’22, overshadowing the 24% returns of the Nifty Private Bank index over the same period. We estimate the top six PSBs under our coverage to report a PAT of INR1.5t/INR1.7tn in FY25/FY26, while the sector’s RoA/RoE are expected to improve to 1.2%/17.9% by FY26E.

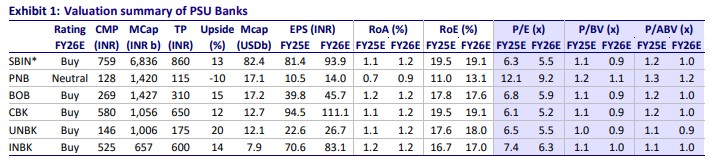

We believe that while the PSU rally has been sharp and the sector has seen significant re-rating, the stock valuations still look reasonable in context to business growth and profitability (~18-19% RoE over FY24-26E).

Considering PSBs’ valuation history, their trading multiples may look constrained now; however, the quality of earnings, growth outlook, and broader re-rating in Public Sector enterprises will enable steady performance for the sector.

PSU Banks are well positioned to pursue healthy growth (given ample balance sheet liquidity) and maintain resilient margins as they benefit from residual MCLR repricing. The decline in bond-yields, along with continued improvement in credit cost (barring SBI), will support healthy profitability.

Several PSBs have raised capital from the market and are thus well poised to benefit from any revival in corporate demand, particularly as the capex cycle recovers after the general elections. We estimate ABV for our coverage PSBs to register a healthy CAGR of ~18% over FY24-26.

We believe that sustained and consistent performance on return ratios and a conducive macro-environment can drive further re-rating of the sector. We maintain our OW stance and roll forward our PTs to FY26. Top picks: SBIN & UNBK