SECTOR OVERVIEW

View and Outlook:

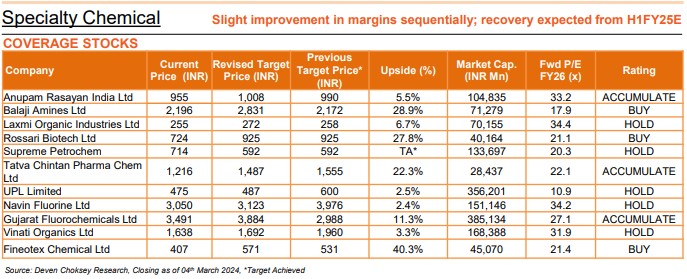

We anticipate that the short-term demand will remain subdued due to global destocking; however, we expect a gradual normalization in the upcoming quarters, with recovery anticipated in H1FY25E. With a modest sequential improvement, specialty chemicals companies are poised to achieve significant volume growth in the foreseeable future. The challenges in the agrochemical sector are anticipated to persist, with recovery expected by the H2FY25E due to export hurdles. However, segments such as personal care, performance chemicals, pharmaceuticals, polymers, and OEM appliances are expected to perform well. We recommend Rossari Biotech as the Company has strong demand from end customer segments, Fineotex Chemicals for its strong growth potential from capacity expansion and improved products mix towards finishing processes and Balaji Amines for the expansion plans and longterm growth prospects.

Revenue was largely in-line, but profitability missed significantly

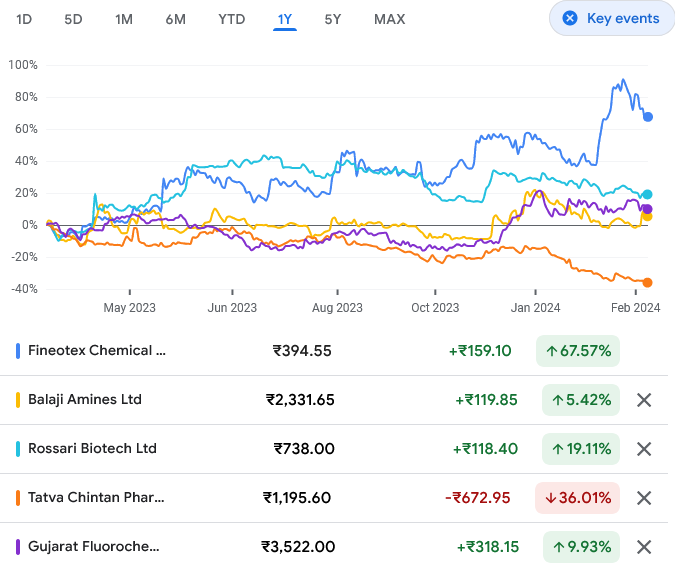

In Q3FY24, our specialty chemicals coverage showed an underperformance compared to estimates. The revenue was largely in-line with our estimate, although EBITDA was 33.3% lower than our estimate, and adjusted net loss was INR 8,026 Mn against our estimated net loss of INR 284 Mn. The EBITDA margins underperformed our estimate by 406 bps to reach 8.0%. Excluding UPL, which was a significant negative outlier in terms of performance, the aggregate revenue growth for our coverage stocks declined by 12.5% YoY (-2.3% QoQ) to INR 51,888 Mn. The corresponding EBITDA (excluding UPL) declined by 39.4% YoY (+2.2% QoQ) to INR 8,119 Mn and EBITDA margins contracted 696 bps YoY (+68 bps QoQ) to 15.6%. Excluding UPL, which generated losses even on an adjusted basis, the adjusted net profit for the remaining coverage universe declined by 49.6% YoY (-1.4% QoQ) to INR 4,161 Mn. On a YoY basis, Gujarat Fluorochemicals, Tatva Chintan Pharma Chem, and Anupam Rasayan reported the highest declines in adj net profit, while Fineotex Chemical and Rossari Biotech posted strong growth.

Global de-stocking, decline in price realization, and export challenges impacted performance of the quarter

Specialty chemicals within our coverage have been challenged recently, primarily due to the steep drop in price realization, diminished demand across end customer segments due to inventory liquidation, and obstacles in exports, attributable to the Red Sea crisis. Overall, it was a mixed bag of results with sequential improvement in EBITDA margins for our coverage (+68 bps). Companies such as Tatva Chintan Pharma Chem and Anupam Rasayan encountered demand challenges as their end customers prioritized inventory liquidation. This was evident in the 12.5% YoY decline in aggregate revenue. Rossari Biotech’s focus on niche segments like specialty surfactants, the phenoxy series, institutional cleaning, and performance chemicals contributed significantly to their robust growth during the quarter. Unlike most other companies under our coverage which experienced stagnant or negative growth, Rossari Biotech achieved double-digit YoY revenue growth. Laxmi Organic Industries witnessed the highest increase in sales volume (+17.0% YoY) during the quarter. The Company’s essentials business segment saw enhancements in the product mix through the introduction of new products, leading to positive YoY revenue growth and improvement in sequential EBITDA margins (+156 bps QoQ). Balaji Amines encountered a mid-single digit decline in overall volumes, primarily attributed to subdued demand within the specialty chemical segment. However, amines and amine derivatives performed satisfactorily, providing support to the overall volume levels. The average price realization per unit for the quarter increased by 3.4% compared to the previous quarter. The sequential enhancement in performance was propelled by a resurgence in domestic demand, leading to an improvement in EBITDA margins by 522 bps QoQ. Gujarat Fluorochemicals observed marginal growth in the bulk chemicals and fluorochemicals verticals on a sequential basis. The improvement in profitability margins sequentially was driven by operating leverage, resulting in an increase of 357 bps QoQ. Amidst prolonged destocking and persistent pricing pressures in the global crop protection industry, UPL’s performance suffered significantly. Distributors in regions such as Brazil, North America, and Europe persisted in destocking or postponing purchases, resulting in a substantial decline in revenue and adjusted net loss