Conservative Investors can use the “Wheel Options Strategy” to trade blue-chip stocks

Many investors are wary about dabbling in options. This fear is justified because the extreme leverage that options carry can expose the trader to extreme risk. That is why Warren Buffett called options “weapons of mass destruction” and warned amateurs to stay away from them.

Nithin Kamath of Zerodha explained the concept in an eloquent manner: “The most fundamental risk management rule when actively trading with leverage is to ensure you don’t take a position so large that it can cause a loss of more than 5% of your trading capital… This rule gets broken often by amateur traders in an attempt to get rich quickly. This is tempting fate. If you somehow did get lucky by being aggressive with leverage, you are most likely to lose it in the long run if you follow the same strategy. Most traders don’t change their trading habits after a large winning trade. Making money will only reinforce the idea that what you are doing is probably the right way to trade”.

However, savvy investors can benefit immensely from a judicious use of options strategies such as the ‘Covered Call‘ and the ‘Cash Secured Put‘. With these strategies, they are exposed to a similar level of risk as they are in their capacity as investors and not much incremental risk. At the same time, they can earn incremental income when the stock is sluggish.

Warren Buffett, despite being the epitome of conservative investors, has himself sold Put Options on the S&P500 Index and earned premium of $4.9B (see his 2008 letter). He explained that the risk of a loss is remote because the Index would have to lose substantial value on or before the expiry date, which is unlikely to happen. He stayed unfazed even during the Covid pandemic crash.

The Wheel Strategy is an endless loop of Cash Secured Puts and Covered Calls

The Wheel strategy is explained in simple language by snider advisors and it is worth quoting the relevant parts:

“The Wheel Strategy, also known as the Triple Income Strategy, is an options trading strategy designed to generate an income from option premiums. If you have enough cash to purchase 100 or 200 shares of a target stock, you can use the strategy to generate premium income and/or potentially acquire the stock at an attractive price.

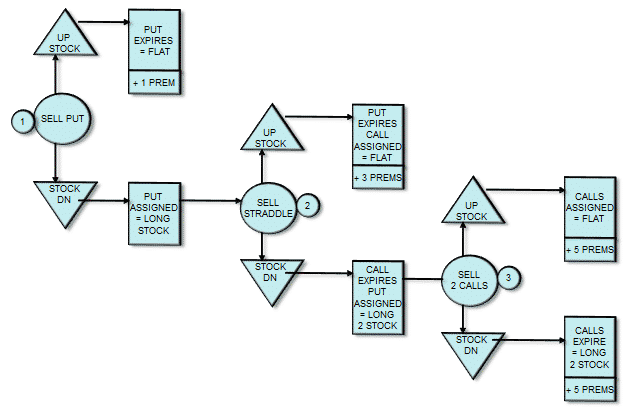

The Wheel Option involves a few steps:

Sell a cash-secured put. The goal is to collect premiums without assignment, but if the put is assigned, the idea is that you will take assignment and hold the stock.

Create a straddle. If the cash-secured put is assigned, sell another cash-secured put along with a covered call to create a straddle.

Sell two covered calls. If the stock goes up, the call option is assigned, and you collect three premium payments. If the stock goes down and you’re assigned 200 shares, sell two covered call options, creating five premium payments in total.

Keep selling covered calls to sell the stock. As you acquire shares through put assignments, you keep selling covered calls over your entire position. Once the calls are assigned, you start over. You can use the same stock again or use a different one.

A simpler version of the Wheel Option involves fewer steps:

Sell a cash-secured put with the goal of collecting premiums without assignment.

Sell covered calls against the stock if it’s assigned to you until one is exercised.

Repeat the process once you sell the stock through a call assignment, you start over. Again, you can repeat the process on the same or different stock.

Of course, the biggest risk with these strategies is that you will average down too far—or the capital loss on the shares exceeds the value of the premium payments received. The less obvious risk occurs when the stock rises sharply higher, which creates a significant opportunity cost since you’re obligated to sell the stock at the covered call strike price.”

It needs to be emphasized that the strategy involves the same risk as we would be exposed to if we invested in the stock. So, we have to be very careful about the stock and ensure that it is investment worthy. Some blue-chip stocks that come readily to mind are HDFC Bank, ITC, HUL, Colgate, NTPC, Power Grid, GAIL etc.

We should avoid volatile stocks like the Adani group, Indigo Air, Aurobindo Pharma etc.

Trader Ranjit Mohanty earned 41.04% in FY 2021-22 versus the Nifty’s return of 18.89%

Trader Ranjit Mohanty deals almost exclusively in the Wheel Strategy. He has explained all the nuances and refinements of the strategy. He also disclosed that in FY 2021-22, he heavily outperformed the Nifty by earning a return of 41.04% versus the Nifty’s return of 18.89%.

However, his performance in FY 2022-23 is not known. It is possible the performance may be slightly subdued as the market was in a Bull phase and a buy-and-hold strategy would have performed better.