Saurabh Mukherjea of Marcellus has cited Tube Investments as an example of ‘Enterprising Compounder’ recently added to Marcellus’ CCP

The rationale is as follows:

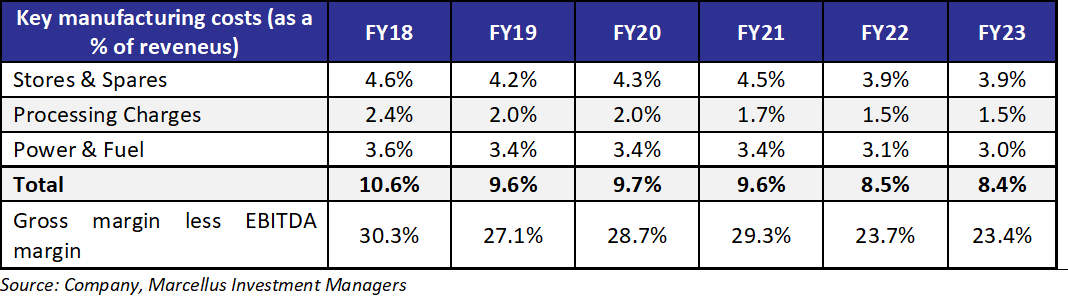

Tube Investment of India (TII): Tube’s core engineering business (TII’s standalone entity) has built competitive advantages in precision steel strips & tubes, automotive & industrial chains and car door frames. Over FY19-24, this core business delivered 19% CAGR in EBIT and 25% CAGR in PAT, with an ROCE/ROIC of 21%/25% respectively. This growth has been supported by the company’s strong focus on extracting operating efficiencies. TII has engaged Japanese consultants like Yasutoshi Washio and firms like Shingijutsu Consulting (founded by a member of the team that developed and implemented the Toyota Production System) to achieve Lean production through Kaizen (‘Continuous Improvement’). To maintain the persistence of these initiatives at TII, they have designated a senior employee at every plant as ‘Kaizen Promotion Officer (KPO)’ who is primarily responsible to drive the initiatives on the shop floor. One week in every two months is designated as ‘Kaizen Week’ where the consultants visit the plant and operational efficiency oriented projects are undertaken. One such example is ‘r eduction in change-over time of tools’ – Each press in the manufacturing process on an average faces 3-4 changeovers per day. These changeovers need to be done as fast as possible to reduce the waiting period. The Tool-room acts as an ‘Operation Theatre’ here. In a recent project, TII reduced the change-over time of a tool from 45-minutes to 9 minutes. Such initiatives have already led to a substantial cost savings on the P&L – as highlighted in the table below. The Management has set a target of reaching 15% PBT margins (12.7% currently) over next five-to-six years of continuous implementation of Lean principles.

It is pointed out that over 80% of the cash flows generated by this standalone business of Tube over the last five years were reinvested to:

– Acquire 58% stake in CG Power – invested in it at the right time (financial distress due to governance challenges) and Mr. Natrajan Srinivasan, a former employee of the Murugappa group, was recalled from his retirement to turn the business around. Over the past five years, CG power’s operating profits have quadrupled and its operating cash flows are targeted towards both its core capex as well as incubation of new businesses such its recent foray into the Outsourced Semiconductor Assembly and Test (OSAT) facility in Gujarat.

– Incubate several new businesses such as commercial electric vehicles (3-wheelers, tractors, LCVs and MHCVs), CDMO (contract manufacturing for global big-pharma), optics (lenses for mobile phones and automotive and industrials purposes) etc. Some of these businesses have made a good start so far. For instance, within the electric 3-wheeler industry (which is already 12% of India’s overall 3-wheeler industry), in the five southern states (TN, KL, KA, AP and TS) Tube is the largest player controlling 26% market share in FY24 and 29% in Apr-May 2024. Benefitting from Chola’s CV finance business and hence superior understanding of different types of cargo movement across the fleet of 3Ws, Tube can segment their target customer base for more relevant product positioning. In heavy commercial vehicles, Tube has targeted a niche of point-to-point cargo movement to overcome the challenge of ‘range anxiety’ in prospective customers. It has sold 44 trucks so far and another 75-80 trucks are under trial with multiple potential customers. Similarly, in its CDMO business, trial shipments of their products have already commenced exports to some of the largest global pharma companies.

Saurabh has added that combining Tube’s core cash generation with the investment value of its majority stake in CG Power and potential success of some (not necessarily all) of the several optionalities that have been incubated by the company, it is expected investment returns from the stock to include benefits of both longevity and optionalities in cash flow compounding in future.