Daljeet Kohli and his followers have already taken home 100% gains from Meghmani Organics. Daljeet first recommended the stock on 6th August 2014 on the basis that the stock is a “classical turnaround story”.

On that date, Meghmani was at Rs. 15. On 12th November 2014 it surged to Rs. 30.70, fulfilling Daljeet’s promise of 100% gains.

However, thereafter, Meghmani has been on a steep decline after it reported poor Q3FY15 results.

The stock is presently at Rs. 15, back where it all started.

Daljeet’s latest update promises that Meghmani will see its days of glory again. He says:

“Meghmani Organics Ltd.(MOL)

Reiterate BUY with previous TP of Rs.34…

We recommended BUY on Meghmani Organics Ltd (MOL) at Rs.15/share on August 6th 2014. The stock already yielded 105% return and touched 52 week high price of Rs.31/share on November 11th 2014. During Q3FY15, the company reported 3.7% Y/Y revenue growth with ~290 bps Y/Y contraction in EBITDA (to 13.6%) margin and net loss of Rs. 45 mn (v/s net profit of Rs.179 mn in Q3FY14). However, the company demostrated strong performance in 1HFY15 (v/s 1HFY14) on back of improved performance in Agrochemical and Pigment business and stability in Basic Chemical segment. The disappointment during Q3FY15 was due to dip in Caustic-Chlorine (Basic Chemical) price, given the significant crash in the crude prices.

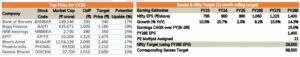

Valuations: At CMP of Rs.15, the stock is trading at EV/EBITDA multiple of 5.0x FY15E, 4.0x FY16E, and 3.2x FY17E estimates. In our view, the current valuations are significantly below 7.5x global peer average. On back of various available triggers (1) debt reduction, (2) margin expansion, (3) higher plant utilization, and (4) favourable business dynamics the stock is poised for re-rating. With revival in business cycle, we have assigned 5.7x EV/EBITDA multiple to arrive at FY17E based price target of Rs.34/share. Given the huge upside, we maintain BUY on the stock.”

Now, the onus is on us to carefully ponder over the situation and decide the appropriate course of action to take.

As scary as sharon bio. Sometime later he will stop covering the stock abruptly.

😀

Exactly!

Agree. One needs to also point out failures as they hurt more

Sharon was a disaster. In a raving bull mkt when everything goes up u have a stock that crashes like a pack of cards one needs to ponder

It sure is a high risk high return stock.. Only for those with high risk appetite..

the target kept “intact” to show that they are ‘still” very confident

even after this the stock price goes down they raise the target meaning they are more confident

even after this stock price goes down they still rise the target to signal that we are very very much confident regardless of the temporary ” clues like global clues ( the meaning none understand so far global clues)

even after these efforts too the stock does not rise the report will be TERMINATED

regards

jacob mathew

Yes.. he’ll later stop covering the stock… like sharon bio..

Sharon is going down,whether it is worth buying at 15.00 level?

Please help dk offload all his holding in meghmani.

haha