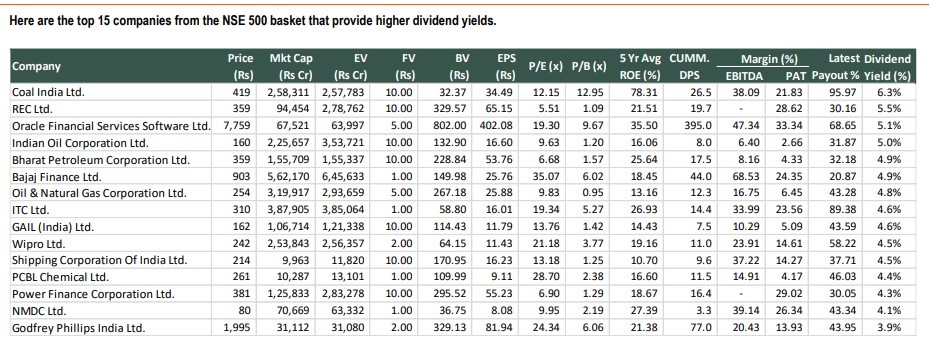

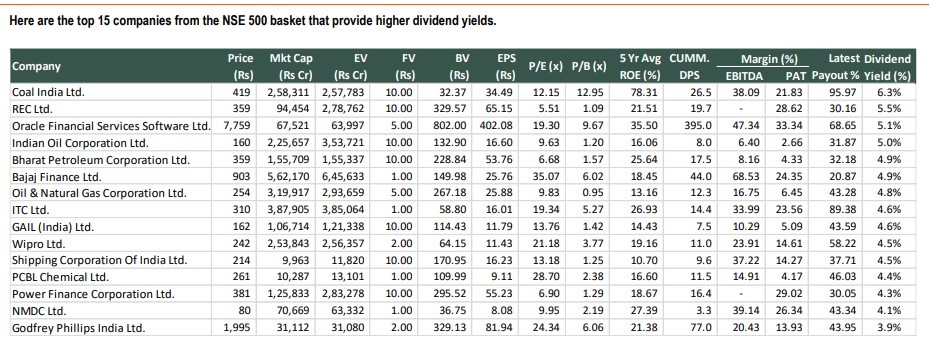

top 15 companies from the NSE 500 basket that provide higher dividend yields

QUALITY DIVIDEND YIELD REPORT

Here are the top 15 companies from the NSE 500 basket that provide higher dividend yields.

Fan Site: Inspired, Not Endorsed, By Rakesh Jhunjhunwala

QUALITY DIVIDEND YIELD REPORT

Here are the top 15 companies from the NSE 500 basket that provide higher dividend yields.