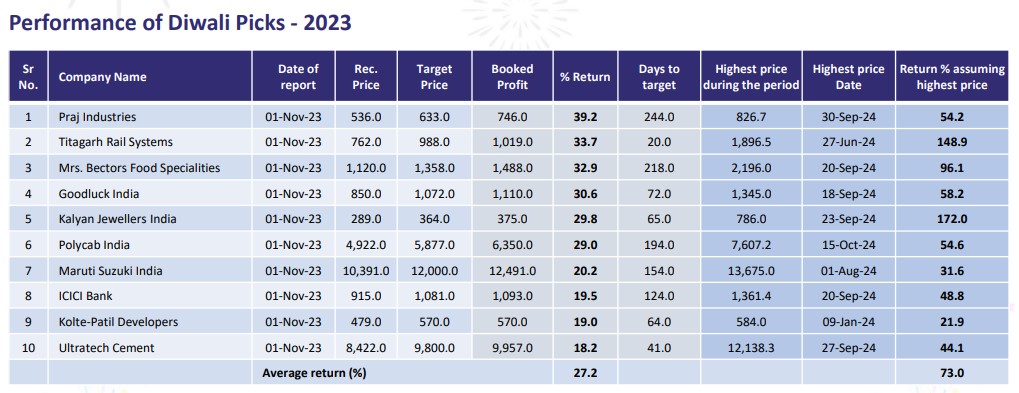

Performance of Diwali Picks – 2023

Our Diwali picks of 2023 have delivered astonishing returns with a 100% strike rate. All 10 recommendations have achieved their target prices thus delivering on an average 27.2% return with an average holding period of 4 months (120 days). This translates into an annualized average return of a whopping 81.6%.

Diwali Picks for 2024

Our View: Nifty50/Nifty Next 50/Nifty Midcap/Nifty Smallcap/NSE 500 have delivered compounded return of 28%/31%/43%/44%/32% during FY20- FY24 period. Taking into account the holistic view, we believe that, SAMVAT 2081 can be the year of consolidation for first few months followed by likely beginning of uptrend post next Union Budget 2025-26 which is likely to be presented in the month of Feb’25. Meanwhile, in the short term, markets are likely to remain choppy on the back of multiple events like US elections and pursuant global trade policies, ongoing geo-political tension, outcome of state elections and government policies (reform-led or populist).

➢ We believe that SAMVAT 2081 is likely to be bottoms-up stock pickers market. Investors should adopt trading/investment strategy so as to preserve the wealth created post Covid pandemic and temper down return expectations for the next 6-12 months. New investors should adopt gradual and well spread-out capital deployment strategy for next 3-6 months so as to reap benefits in the second half of Samvat 2081.

➢ Sector to focus on: Consumption, Auto, BFSI (Banks, AMCs, Insurance, NBFC, Stock market intermediaries), Real Estate, Travel & Tourism, Engineering & Cap Goods, Railway Wagons, Telecom and fast growing sectors like Renewables, EMS, etc.