First, we must compliment the financial journals for following the salutary practice of making stock recommendations. This makes the onerous task of finding winning stocks so much easier for novice investors like you and me.

Outlook Business roped in 13 eminent stock pickers of impeccable credentials to short-list 13 top-quality mid-cap stocks for us to consider.

CNBC TV18 persuaded four ace stock pickers with a proven track record to recommend as many as 16 top-quality stocks for us to ponder over.

In the earlier years, Forbes India used to get stock wizards of the calibre of Sanjoy Bhattacharyya to create a ready-made Model Portfolio for us.

Sanjoy Bhattacharyya, true to his reputation, paid careful attention to the fundamentals and valuations, and cherry-picked only a few stocks, each of which is a blockbuster today.

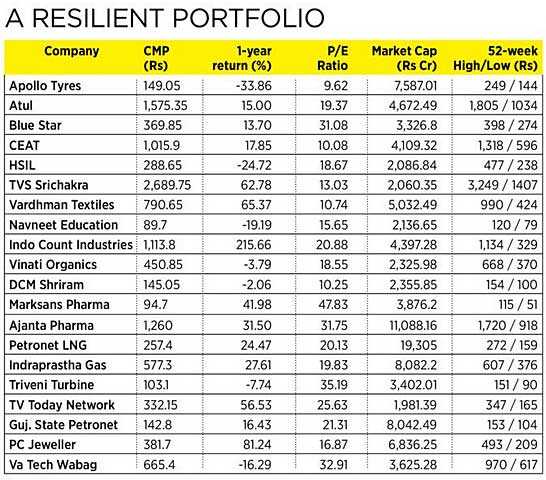

For 2016, Forbes India has unfortunately not been able to persuade any heavyweight stock picker to offer recommendations. However, this is a not a reason for disappointment because Pravin Palande, the in-house stock expert at Forbes India, has done a splendid job with the stock selection:

Of the 20 stocks, we are very familiar with HSIL because it is also the favourite of three ace stock pickers, Daljeet Kohli, Porinju Veliyath and Vineeta Mahnot. According to the experts, HSIL is destined to go places owing to its “strong brand, variety of product portfolio, and very strong distribution network across the country”.

TV Today also needs no introduction to us given that it is backed by the mighty Radhakishan Damani and Ramesh Damani. The stock has also been recently recommended by Microsec. The impending digitization is expected to benefit TV Today in a big way and catapult it to new heights.

Ajanta Pharma is yet another powerhouse Pharma stock that is a must have. We have watched the stock blossom into a magnificent 10-bagger before our very eyes. Raamdeo Agrawal calls the stock a “dark horse” and uses it as an example in each of his Wealth Creation Studies to explain how a stock with the right ingredients can create enormous wealth for its shareholders.

PC Jeweller has won the confidence of Brahmal Vasudevan’s Idria Capital. Brahmal described PC Jeweller as “an exceptional co experiencing a phenomenal growth rate” and it is living up to expectations.

Vinati Organics is a favourite stock of Ayaz Motiwala Of Nivalis Partners. He said Vinati has a “unique competitive advantage” and is a must-buy. Motilal Oswal has also recommended a buy of Vinati Organics.

Each of the other stocks is a winner as well!

May be these are all winners but it will be best not to buy in today’s market conditions, bcs you will just loose money due to volatility and fluctuations.

I feel most of them are overpriced. Another 15-20% fall will make them attractive. But fundamentally most of them are strong.

Doesnt inspire much confidence specially at current valuations

Vardhman textiles is a great company .HSIL is also looks to be a good pick .

Still dont jump to HSIL, even am holding a small quantity, but i believe it will still go down.

Amazing response from the readers. After 30-50% fall in stocks, they still want them another 20% cheaper. How quickly sentiments change.

When you see money vanishing in front of your eyes. Everyone thinks twice.

Foobar, Its not about how much it has fallen…its all about how much i am ready to pay. Basics of value investing brother.