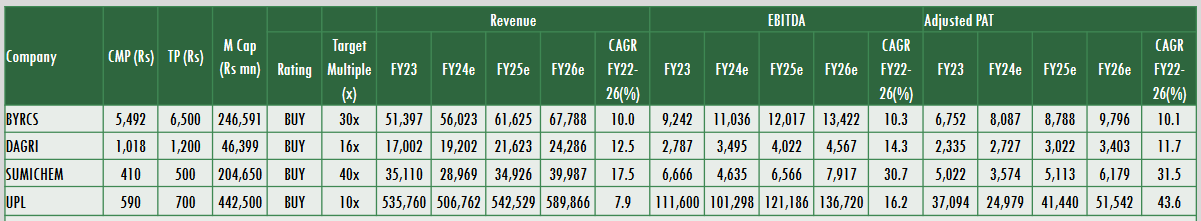

We cover four companies in this report, recommending Buys on Bayer Crop Science, Dhanuka Agritech, Sumitomo Chemicals and UPL. Top Pick Sumitomo Chemical: We prefer Sumitomo Chemicals (India) in agrochemicals, as we believe worst in terms of volume growth and pricing pressure is largely behind and expect gradual recovery as higher stocks piled up globally have started to normalise (barring the US). Price drops in the last few months seem to have been arrested for now. Hence, we believe a gradual recovery in revenue growth and margins cannot be ruled out. Further, the company is poised to post 4%/7% revenue/PAT CAGRs over FY23-26 (FY18-23: 13%/28%). The company had a healthy 28% RoE, 23% pre-tax RoCE and net cash balance sheet in FY23. We initiate coverage on Sumitomo Chemicals with a Buy at a TP of Rs.490, 40x FY26e EPS.

Sumitomo Chemicals, India – Near term hiccups; long-term intact; Buy

Strong parental advantage to support growth. Strong parental support from Sumitomo Chemical Corporation (SCC) gives its Indian subsidiary unique advantages such as a) access to SCC’s portfolio; b) technical and R&D expertise to develop proprietary products and c) financial strength and a wider market reach. To be the ‘go to guy’ for SCC’s generic exports globally. The Indian arm is the only technical and generic grade manufacturing site of the SCC group outside Japan. It intends to enhance exports by levering SCC’s global supply chain and marketing network (received approvals for five molecules). We expect its export revenue to record a 35% CAGR over FY24-FY26 (FY20-FY23: 23%) on the back of SCC’s intent to maximise synergies from the integration of Nufarm’s distribution business in LATAM and Sumitomo India’s exports.

Outlook and Valuation. Considering the above, the company is poised to post 4%/7% revenue/ PAT CAGRs over FY23-26 (FY18-23: 13%/28%). Further, the company had a healthy 23% RoE, a 30% pre-tax RoCE and a net-cash balance-sheet in FY23. We initiate coverage with a Buy at a TP of Rs.500, 40x FY26e EPS

Bayer Crop Science – Market dominance likely to endure; Buy

Market dominance in domestic agrochemicals. Strong brand recall and superior products have helped Bayer Crop Science dominate domestic agrochemicals with a ~17% market share (in FY23), and a ~40-45% market share in rice hybrids. Product launches to propel growth. The company is on track to launch several innovative products from the parent in the next few years (it launched 25 products over FY15-FY24 ytd). This in turn would support overall growth ahead. The company has registered three products in FY23 and FY24 ytd, likely to reap benefits in future

Outlook and Valuation. The better product mix (greater contribution of maize hybrids in overall revenue) has in turn resulted in the company’s decent margin improvement in H1 FY24 despite the uncertain crop protection environment. Ahead, we believe dominance in domestic crop protection and the greater contribution from maize hybrids would support earnings. The company is likely to post 10%/13% revenue/PAT CAGRs over FY23-FY26. The earnings growth trajectory is robust, with debt free balance sheets and strong cash-flows. We initiate coverage on the company with a Buy at a TP of Rs6,500, 30x FY26e EPS

Dhanuka Agritech – Making a foray into technical manufacturing to aid sustainable growth; Buy

Asset-light business model with an extensive distribution network. Dhanuka Agritech has a unique asset-light business model (three formulations facilities; focusing on new products, supported by tie-ups with global giants) reinforced by an extensive marketing network (6,500 dealers/distributors, 80,000 retailers), giving it an edge over competitors Foray into technical manufacturing to aid sustainable growth: The company’ made a foray into technical manufacturing at Rs3bn capex (to be spent over FY22-24; funded through internal accruals) at Dahej, Gujarat (with Rs1.5bn-2bn revenue potential in FY24 and Rs3bn from FY25). Phase-1 of the formulations unit has already gone commercial from Aug’23 (with one molecule currently; potential to manufacture 4-5 molecules at this MPP), while the technical unit will go commercial by FY24. It will largely take care, through backward integration, of generics required

Outlook and Valuation. We believe the successful execution and ramp-up of the Dahej project would set the company on the next leg of growth, which would lead to re-rating the stock over the longer term. The company has a good distribution-led business model with robust RoE (>23%) and balance sheet. We expect it to register 13%/ 13% revenue/PAT CAGRs over FY23-FY26, boosted by the healthy demand context and product launches. We initiate coverage on the company with a Buy at a TP of Rs.1,200, 16x FY26e EPS

UPL – Challenges subsiding; Buy

LATAM is the key region for UPL (~40% of revenue). Brazil is the fastest growing region for UPL (FY23e ~$1.5bn revenue; ranked fourth-largest in Brazil). It brings >50% to LATAM revenues and is expected to grow twice that of the industry over next few years on its strong product pipeline and widening distribution reach Margins expected to recover from H2 FY24. We expect a gradual recovery in margins from H2 FY24 (now showing early signs), as the drop in finished goods prices (in line with the fall in RM prices) seems to be arrested. This, liquidation of high-cost stocks and stable RM costs are likely to result in margin expansion in H2. UPL generates ~60% of its annual revenue/ profitability in the second half of the year, with the last quarter bringing ~30%. Thus, we expect a strong margin expansion in Q4 to be aided by a) greater operating leverage and b) low base

Outlook and Valuation. We anticipate the better performance in H2 FY24, particularly in Q4, to be driven by the improved demand context across markets (barring NAFTA), supported by higher commodity prices. We expect UPL to clock 3%/12% revenue/PAT CAGRs over FY23-26. We initiate coverage on the company with a Buy at a TP of Rs.690, 10x FY26e EPS

Click here to download report on 4 Agrochemicals Stocks to buy by Anand Rathi