Weak quarter; focus on CY24

The IT sector (coverage universe) is expected to post a weak quarter with a sequential decline. This is due to increased furloughs, Q3 seasonality, a prolonged deal conversion cycle, and compression in discretionary and renewals. Positive factors for the quarter include the ramp-up of mega deals (BSNL/Verizon for TCS/HCLT) and consistent deal activity. However, most of the supply-side indicators, such as tech job postings, remain soft and do not signal any recovery ‘yet’. Although the recent trajectory of rates can support valuation multiples due to a high inverse correlation, it’s unlikely that tech budgets will improve materially. This is because a ‘slowdown’ in economic growth remains a baseline scenario, leading enterprises to prioritise cost optimization over transformation initiatives. In the Indian IT landscape, we expect three developments: (1) growth divergence within the sector in the near term, (2) margin recovery with favourable supply-side factors, and (3) mid-tier IT sustaining its relative outperformance. However, the margin of safety is low on aggregate, as valuations have approached +2 SD (rerated higher by >20% in the last six months) with limited immediate upside triggers. We maintain our preference for LTI Mindtree, Persistent, and Birlasoft.

Q3FY24E performance: For Q3, revenue growth divergence is from -2% QoQ to +3.5% QoQ for tier-1 IT and mid-tier IT growth is ranging from -1% QoQ to +4% QoQ. Within tier-1 IT, we expect HCLT to lead growth at 3.5% QoQ while WPRO/TECHM/INFO are expected to post a sequential decline of 2%, 1% and 1% respectively; TCS is expected to post 1% growth. Margins for the sector are expected to be impacted by greater impact from furlough and seasonality and wage increases (Infosys, HCLT, and Birlasoft). In mid-tier IT, Sonata (Travel and Hi-Tech), LTTS (SWC seasonality) and Tata Elxsi (Transportation and Medical) are expected to outperform on growth while Mphasis (organic) and Zensar are expected to underperform with a sequential drop in revenue.

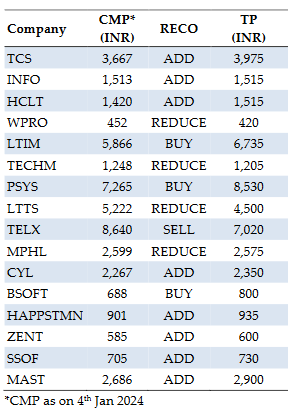

A downward revision to guidance likely, focus on CY24: We expect TCS to clock deal bookings of USD 9bn+ TCV in Q3, HCLT to clock USD 2.5bn+ new deal TCV and TECHM could be at sub-USD 500mn TCV. Deal activity in the quarter was strong in the manufacturing/automotive verticals, which included LKQ Europe/TK Elevator/smart Europe GmbH by Infosys, Husqvarna by HCL Tech, Marelli by Wipro, and Ammega by Sonata Software. We expect Infosys to revise its FY24E revenue guidance to 1-2% (1-2.5% earlier) and HCLT to revise its FY24E revenue guidance to 3.5-4.5% (5-6% earlier). Key monitorables include deal bookings and pipeline, progress on mega deals, commentary/outlook on CY24 tech budgets of enterprise clients and discretionary spending, outlook on BFSI vertical, competition from GCC, and headcount/supply-side trends. Downgrade Wipro to REDUCE (from ADD) and Mphasis to REDUCE (from ADD). Maintain our selective stance on the sector and stock preference for LTI Mindtree within tier-1 IT and Persistent Systems and Birlasoft within midtier IT. Over the last 3M, the IT index has gone up in double digits despite a ~2% cut in EPS estimates (increase in mid-tier IT EPS estimates).

Click here to download IT – Q3FY24 Results Preview by HDFC Sec

Leave a Reply