Repair, Reform, Reset

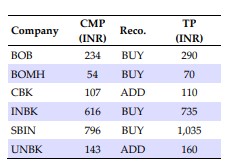

The Indian PSU banking (PSB) sector, once considered structurally broken, is experiencing early signs of a secular turnaround, buttressed by a combination of governance reforms (balance sheet repair and recapitalization), modernized digital stack, and a gradual turnaround in the quality and sustainability of earnings. This is beginning to reflect in PSBs finally stabilizing their loan market share (+52bps market share gains during FY25), enhancing the quality of their customer franchise and service standards, and improving their return ratios. Despite improving profitability (FY25 RoAs approaching 1%), investors remain skeptical of the sustainability of these earnings. Our analysis suggests that PSBs are on the cusp of a structural reflation in their core profitability trends over the medium-term. We construct a first-of-its-kind, proprietary “HSIE PSB Scorecard,” to contrast PSBs across multiple parameters. We believe that the PSB universe selectively offers a favourable risk-reward, especially mid-tier PSBs with scalable franchises, clean books, and likely recapitalization triggers. We reiterate SBIN (TP INR1,035) as our highest-conviction BUY; across each successive market capitalization bucket, our high conviction BUYs are: BOB (TP INR290), INBK (TP INR735), and BOMH (TP INR70). We also initiate on UNBK (ADD, TP INR160) and CBK (ADD, TP INR110).

▪ Balance sheets repaired: While the post-Covid PSB gross slippages (1.4%) have moderated below those of private banks (2.4%), PSBs have resorted to aggressive write-offs (1.3% of assets), reflecting in higher credit costs, simultaneously delivering an accelerated balance sheet clean-up. While we expect a general upward normalization in credit costs across banks, the new normal PSB loan book is likely to be less corporate-heavy and hence, less vulnerable to any sharp volatility in asset quality.

▪ Core earnings have further leg room: Given the relatively lower mix of fixedrate loans in their respective portfolios (~10% v/s ~30% for large private banks), PSBs have traditionally witnessed a sharp NIM compression during the down leg of the rate cycle. Our discussions with bankers suggest that PSBs are likely to incrementally migrate their vehicle loans to a fixed-rate book (in line with private banks). Also, we believe that PSBs are likely to mirror SBI’s move of trimming their SA pricing in the near-term. Our analysis suggests that PSB core earnings are likely to witness 15% CAGR over FY25-27E on the back of normalization in NIMs, and productivity and efficiency gains.

▪ Dashboard: We construct a proprietary “HSIE PSB Scorecard” to compare, and contrast PSU banks on a series of qualitative and quantitative parameters across multiple frames of assessment.