Diamonds In The Dust Samvat 2081

Samvat 2081 is set to be a pivotal year for the global economy. We begin this new Samvat amid a global rate cut cycle, with the US FED reducing interest rates by 50bps during its Sep’24 FOMC meeting and signalling two more rate cuts for the remainder of 2024, along with the possibility of four additional cuts in 2025. In response to this development, the RBI, in its recent MPC meeting, shifted its policy stance from “withdrawal of accommodation” to “neutral,” signalling that a rate cut could be expected within the next 6-9 months. For Samvat 2081, we anticipate one to two rate cuts from the RBI, contingent upon inflation trends and the broader growth dynamics. The RBI has retained its FY25 GDP growth forecast at 7.2%, driven by improved agricultural activities and a positive outlook for rural consumption. Additionally, rainfall during the monsoon season (Jun-Sep’24) was 4% above the long period average (LPA), and reservoir levels across the country are higher than last year. These favourable conditions are expected to benefit the rural economy, enhancing the prospects of a strong second crop (Rabi) this year.

Key Monitorables in SAMVAT 2081: With two major domestic events—the Union Election and Union Budget—and the global “US FED rate cut cycle” now behind us, the market’s focus will shift to closely tracking several key events: 1) Developments in the lead-up to the US election, 2) Economic recovery in China, 3) Activity during the festival season, 4) US bond yield movements, 5) Oil price trends, and 6) Fund flows. These factors are expected to introduce volatility to the Indian equity market, which could react in either direction depending on how these events unfold. In the near term, some capital allocation may shift towards China, given the latest developments there.

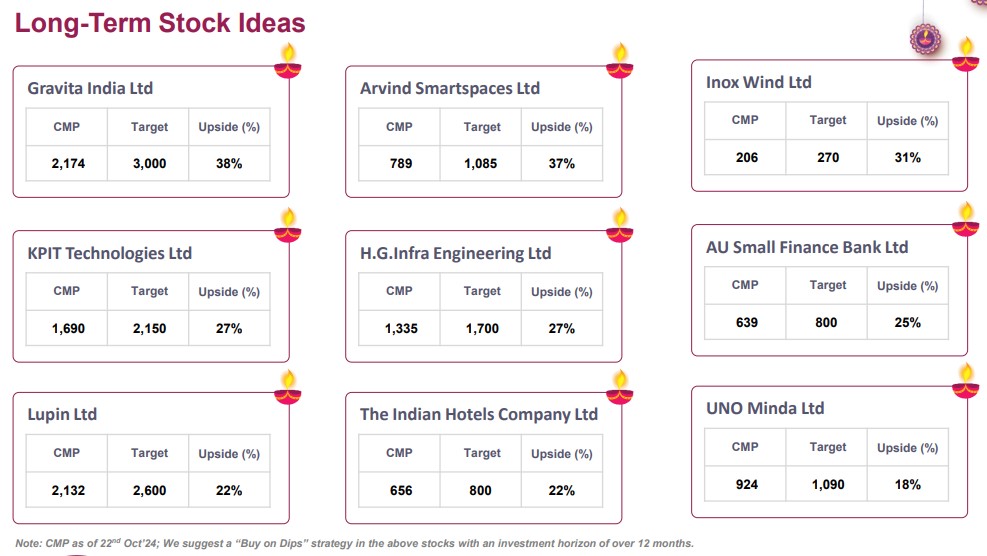

In any case, we continue to believe in the long-term growth story of the Indian equity market. However, with current valuations offering limited scope for further expansion, an increase in corporate earnings will be the primary driver of the market returns moving forward. Hence, bottom-up stock picking with a focus on ‘growth at a reasonable price’ and ‘Quality’ would be keys to generating satisfactory returns in the next one year. We also suggest a “Buy on Dips” strategy in the below stocks with an investment horizon of over 12 months.

We present the following themes for Samvat 2081:

• Companies with higher growth potential with reasonable valuations

• Leadership position in the respective business

• Companies with a proven track record of improving return ratios

• Right mix of Rate Cut Cycle, Defensive, Capex, Consumption and the Export-oriented themes

Based on these themes, our Diwali picks are: Gravita India; Arvind Smart Spaces; Inox Wind; KPIT Technologies; HG Infra; AU Small Bank; Lupin; Indian Hotels; UNO Minda