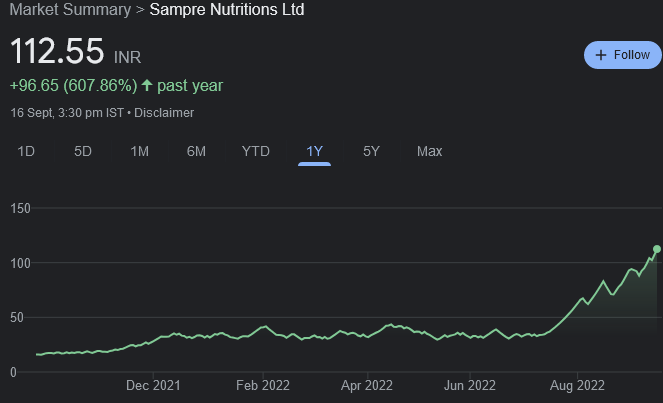

Multibagger Nano-cap stock

Sampre Nutrition is a nano-cap with a market capitalisation of Rs 54 crore and a free float of Rs 25 crore.

According to the Company’s website, the company is engaged in manufacturing complete range of confectionery, éclairs, candies, toffees, powder and centre filled products.

It supplies products to companies like Procter & Gamble, Warner Lambert, Boots, Nestle, Cadbury, Krafts Food and other major Indian Companies.

The Company is promoted by Mr. B. K. Gurbani, a first generation entrepreneur. He started the business with two manually operated Lolly Pop machines over 20 years ago with a team of just 10 persons in a tiny tenement. The Company now has a work force of more than 450.

According to a report in the ET, Sampra Nutrition is the only Indian company approved by global pharma giant Proctor & Gamble Health (P&G) to export Vicks Cough Drops in Japan.

It is also stated that Sampre, in association with Micro Nutrient Initiatives Canada, has developed vitaminized nutri-candy which has proven therapeutic effects of improving haemoglobin levels.

Sampre is also said to have formulated and developed a hard boiled candy, which was offered to DS Group, who ultimately launched this raw mango fruit flavoured and masala-filled candy under ‘Pulse’ brand in the market.

The company also offered a similar raw mango fruit flavoured and masala-filled candy to Baba Ramdev’s Patanjali Foods, which launched it under ‘Hi Kick’ brand name.

The company has been associated with leading brands for their flagship products including ‘Vicks’ for Procter & Gamble, ‘Hajmola’ for Dabur, ‘Rapid Relief’ for Cipla, ‘Eclairs’ for Cadbury and ‘Frutus’ for Nestle.

Sampre Nutritions Ltd – Financial Overview

| Particulars (Rs cr) | 2022 | 2021 | 2020 |

| Net Sales | 23.13 | 18.23 | 24.85 |

| Operating Profit | 3.77 | 3.46 | 4.08 |

| Other Income | 0.28 | 0.03 | 0.18 |

| Interest | 1.77 | 1.54 | 2.13 |

| Depreciation | 1.63 | 1.81 | 1.49 |

| Profit Before Tax | 0.37 | 0.11 | 0.46 |

| Tax | 0.06 | 0.03 | 0.12 |

| Profit After Tax | 0.31 | 0.08 | 0.34 |

| Share Capital | 4.82 | 4.82 | 4.82 |

| Reserves | 6.27 | 5.96 | 5.89 |

| Net Worth | 11.09 | 10.78 | 10.71 |

| Loans | 21.23 | 21.23 | 20.15 |

| Gross Block | 39.52 | 33.57 | 37.22 |

| Investments | 0.01 | 0.01 | 0.01 |

| Cash | 0.08 | 0.10 | 0.85 |

| Debtors | 5.97 | 6.22 | 3.58 |

| Net Working Capital | 10.12 | 8.94 | 6.90 |

| Operating Profit Margin (%) | 16.30 | 18.98 | 16.42 |

| Net Profit Margin (%) | 1.34 | 0.44 | 1.37 |

| Earning Per Share (Rs) | 0.64 | 0.16 | 0.70 |

| Dividend (%) | 0.00 | 0.00 | 0.00 |

| Dividend Payout | 0.00 | 0.00 | 0.00 |

(Source: Business Standard)

FII named Eriska Investment Fund bought 50,000 equity shares

The ET stated that a Mauritius-based FII named Eriska Investment bought 50,000 equity shares in Sampre Nutrition at an average price of Rs 101 per share in a bulk deal. The deal amounted to Rs 50.5 lakh.

A study of the public shareholders list shows that an individual named NITIN SHARMA holds 71,482 shares. A company named RASADA ENTERPRISES PRIVATE LIMITED holds 60,955 shares.

The promoters, namely the Gurbani family, holds 52.78% of the equity capital of the Company.

However good the fundamentals are, microcaps are not the right tool in these risk off times. Gokulram Arunasalam