Volatile stocks offer very high premiums, especially during earnings releases, but are also very dangerous

A young trader with the nickname NanoBytesInc on YouTube and Reddit has fairly admitted that he is addicted to gambling on the stock market. He buys and sells Calls and Puts in a reckless manner and risks large sums of money.

In a Vlog posted on 26th January, the trader boasted that he had earned 120000 in three days. He did not reveal the source of these gains or the trades that he had taken.

He bet the entire gain on selling a Tesla Call Spread on the eve of its earnings release.

“We are betting on Tesla. It is releasing its earnings after hours. If the results are bad and Tesla stays below $150, I make $50,000. If the results are good, I lose $120000,” the trader said explaining his strategy.

Unfortunately for him, Tesla reported blockbuster results which caused the stock to surge 33%. Call writers were obviously trapped.

https://twitter.com/CNBCTurkce/status/1619162267383386113

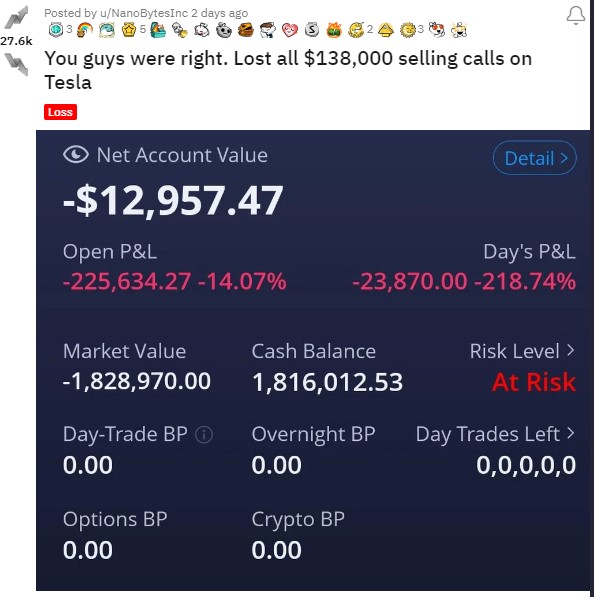

NanoBytesInc bravely reported that he had lost a sum of $136000 which amounts to about Rs 1.10 crore.

The trader also posted his ordeal on WallStreetBets where several other traders consoled him on his loss. However, some blasted him for the display of recklessness.

Dalal Street traders also play big and win and lose big

It is worth noting that some traders on Dalal Street are as adept as their Wall Street counterparts in betting big sums of money. Recently, a trader with the nickname ‘bulkindextrader’ reported a massive single-day loss of Rs. 4.4 crore. He attributed the loss to “poor risk management” (see A trader lost Rs 4.4 Crore (38% of capital) today due to the unexpected plunge in the Nifty).

There is also the example of a corporate trader named BSEL INFRASTRUCTURE REALTY LIMITED who reported verified annual profit of Rs 32 crore on capital of Rs 30 crore, which is a RoI of more than 100% (see Algo trader has earned profit of Rs 32 crore in 12 months on capital of Rs 30 crore which is a return in excess of 100%).

How to trade earnings announcements with options strategies

Earning releases can be a great source of profit for sharp traders provided it is executed in the proper manner. Experts at SMB Capital have advised, with real-life examples, that Call Calendars or Double Calendars are the best way to profit from the wild swings that the stock is likely to witness in the aftermath of the results announcement.

“My personal preference with double calendars is to sell weeklies, because that gives me the flexibility as I roll out to the following week, to modify the trade to a diagonal on the hot side, and if it makes a substantial move, if I have bought in pairs, which you did in this video, I can roll half of my hot side sell contracts each Friday, converting the diagonal side to a ratio diagonal spread. I also like to be closer to the money on both sides if I can afford it, so I have a greater chance of going in the money on the longer term bought options,” an experienced trader named Brett Elmer Elmer said in response to the above video.

Another way to play earnings releases is through an ‘Iron Condor’ or an ‘Iron Fly’ where the rewards are attractive and the risk is kept in check.

“AAPL earnings was a good play. I used a put credit spread for the 149-150 strikes for an overnight 10% gain I wasn’t sure about the upside but I felt fine at $150 support so a put credit spread was the play for me on AAPL. Really with the overall volatility of the market a put credit spread on the index is making me money too,” a viewer commented sharing his perspective on trading earnings releases.