Company Overview:

The company primarily focus on providing mortgage loans to economically weaker and low-to-middle income customers in India. Its target market is individuals seeking small ticket sized loans of less than Rs 15 lakhs. The average loan size offered by the company is Rs 9 lakhs to Rs 10 lakhs with an average loan-to-value ratio of 58.3% as of Dec’23. In 9MFY24, the company had the highest assets under management (AUM) and net worth among its peers. In FY23, the company also had the highest number of live accounts. The company has a presence across 20 States and Union Territories which is the most extensive coverage among its peers. The diversified reach of the company is well positioned to meet the specific needs of target customers across geographies in urban and semi-urban areas.

Key Highlights:

1. Major player in affordable housing: The company has a seasoned business model showcasing strong resilience through different business cycles. Its customer centric lending services aim to improve the economic well-being of its customers, especially those earning less than Rs 50,000 per month. The company provides loans for affordable housing schemes like Pradhan Mantri Awas Yojana benefiting those in urban and semi-urban areas. As of Mar’23 and Dec’23, Rs 13,049.7 cr or 75.8% and Rs 14,488.0 cr or 72.9% of the Gross AUM were from these groups. As of Mar’23 and Dec’23, 87.1% and 85.5% of the live accounts were from these groups.

2. A robust comprehensive system for credit underwriting, collections and monitoring asset quality: The company has a “risk appetite statement” that sets out the acceptable levels and types of risk. The company has specialized teams for credit underwriting, due diligence, and fraud control. As of Mar’23 and Dec’23, the loan-to-value on Gross AUM on an outstanding basis was 57.8% and 58.3%. Further, it has an in-house collections team to ensure timely collections, the collection efficiency as of Dec’23 stood at 99.1%. As of Mar’21, Mar’22, Mar’23, Dec’22 and Dec’23, the GNPAs accounted for 1.1%, 1.5%, 1.2%, 1.8% and 1.4% respectively while Net Retail NPAs accounted for 0.7%, 1.1%, 0.8%, 1.3% and 1.0% respectively of Retail AUM.

3. Strong parentage and professional management team: BCP Topco, Promoter, is an affiliate of funds managed and/or advised by affiliates of Blackstone Group Inc currently holds 98.72%. It has a strong and experienced management team comprising sixteen members. The management team brings a diverse array of backgrounds with a mix of professionals from the financial services industry.

4. Geographical Presence: The company has a wide-spread reach with 487 branches and 109 sales office networks covering 20 States and Union Territories of India. Almost 56.3% of the branches and 55.9% of sales offices are spread across five states and the remaining 43.7% and 44.1% are spread across 15 states. The company has actively expanded the branch and sales office network from 310 branches in Mar’21 to 487 branches in Dec’23. The company’s gross AUM is spread across India with only 27.6% of the Gross AUM coming from the top two states as of Dec’23.

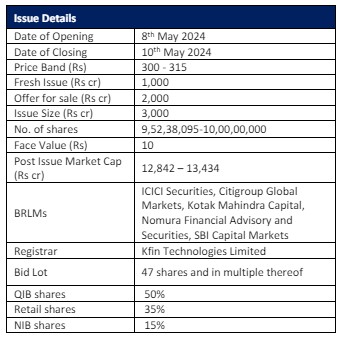

Valuation: The company is valued at P/BV of 2.4x/2.5x of its 9MFY24 financial data at the lower and upper price band respectively on post-issue capital. Aadhar Housing Finance Limited serves customers in India’s tier 4 and tier 5 towns targeting lower income segment with a ticket size of Rs 15 lakh. The technology based lending company has 487 branches covering almost 533 districts across 20 states. The company is well-placed to cater to the niche segment with strong origination skills, understanding of the customers’ needs as well as focus on smaller cities. We expect these factors will help in garnering market share going ahead.

Click here to download Aadhar Housing Finance Limited IPO Note by SBI Securities

Leave a Reply