Growth outlook remains strong…

About the stock: Action Construction Equipment (ACE), established in 1995, is India’s leading Material Handling and Construction Equipment manufacturing company and are market leaders in Mobile Cranes & Tower Cranes segment

• As of 9MFY25, cranes, construction equipment & material handling segment contributes ~92% to total revenue while agri equipment contributes ~8% to total revenue

Investment Rationale:

• Robust capex scenario augurs well for company’s products: We believe that buoyant capex prospects (public & private) across the manufacturing & infrastructure segments, presents substantial opportunity for the company’s products in cranes, construction equipments, material handling etc. The company, already a market leader in cranes segment with 60%+ market share, is well poised to capture the Industry’s strong growth potential. Also, India’s emergence as one of the best choices in manufacturing capital goods equipments provides a sizable opportunity to company to increase its exports

• Focus on increasing capacities and improving product portfolio: ACE is focused on improving its market shares in both domestic and export markets in its key segments like cranes and construction equipments through capacity additions & improving product portfolio (like medium to large cranes, electric cranes, backhoe loaders, telehandlers etc) and exploring JVs and acquisitions. From January 2025, the revised emission norms (CEV-5 norms) have also kicked-in and with this, company has started manufacturing cranes and other equipments as per the new norms. Realisation of these new products are expected to be higher by 8- 15% as compared to existing product portfolio. Company is looking to cater both domestic markets and exports with these new products

• Poised for a strong growth ahead across the key segments: For FY25E, management expect overall revenue growth of 15%+ with sustainable EBITDA margins. With recent increase in capacity, the potential revenue has already reached at Rs 5000-5100 crore. Company targets to double revenue by FY26E (from FY23 level), which implies ~21% CAGR (FY24- 26E). In terms of exports, company intends to increase its exports share to 15% of revenues in medium term (from ~8% at present). Margins are expected to improve further gradually, led by operational efficiencies, favourable product mix and positive operating leverage

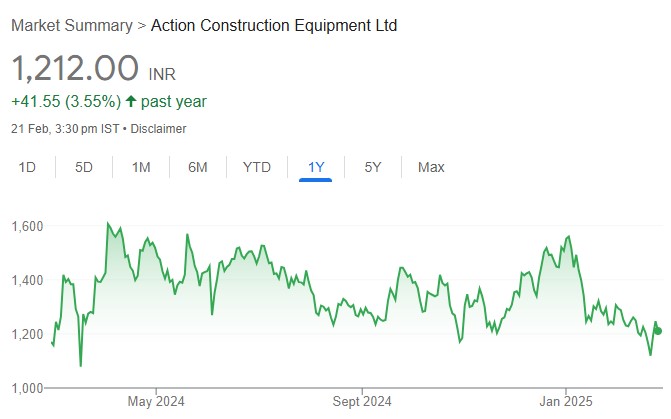

Rating and Target Price

• With strong focus on increasing competitive strength through augmenting capacities and improving product ranges, we believe company’s operational performance to remain strong in the coming period too

• Valuation at 24.4x P/E on FY27E basis looks attractive given the strong industry tailwinds and healthy visibility on earnings growth in the coming period. We recommend BUY on ACE with a revised target price of ₹ 1500 per share (based on 30x FY27E EPS)