Superlative Performance; High Quality Growth Pick

Summary

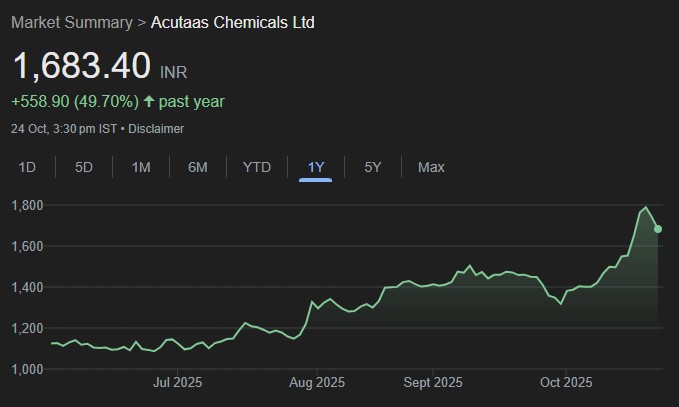

Acutaas Chemicals registered a superlative performance in Q2FY26. Revenue, EBITDA and PAT registered strong growth of 24%,95% and 94% respectively on YoY terms. We believe the company will can clock in revenue CAGR of 25-30% for the next 2 years with margins upwards of 29%. The growth will be propelled by strong growth in the advanced pharma intermediates business owing to strong traction in CDMO business and targeting of more molecules which will go off patent. We believe that strong traction in key molecules will continue along with further scale up of CDMO business with the increasing ramp up of the Ankleshwar unit. We have revised estimates upwards to factor in stronger margin profile. We maintain our BUY rating with revised TP of Rs2,141 (50xFY27 expected EPS) on account of the strong tailwinds in the core business.

Key Highlights and Investment Rationale

Margin Guidance increased to 28-30% for FY26 and FY27: The primary business of Advanced Pharmaceutical Intermediates (API) exhibited healthy growth of 27% YoY owing to healthy traction particularly in the CDMO business. Healthy growth in the core advanced intermediates business was led by volume and realisations as well. Cost optimization benefits, churning out lower margin products and favourable product mix led to healthy margin delivery of 30%+ for the API segment. The management expects to finalise 3 more CDMO contracts in the near term with size ranging from Rs 500 mn to 1bn each.

CDMO and Capex: The overall target for the company is to take CDMO revenue to Rs 10 bn by FY28. The company has pencilled in capex of Rs 2.5bn for FY26 with it majorly comprising of the electrolyte additives capex, maintenance capex, solar power plant and pilot plant at Sachin.