Volume growth driven by containers; focus on capacity expansion

Adani Ports & SEZ (APSEZ) handled 408.7mmt (+7% YoY) of cargo volumes over Ap’24-Feb’25 (11 months of FY25). During the same period, cargo volume handled at major ports in India grew ~3% YoY. Hence, APSEZ continues to grow over 2x the industry rate, driven by higher efficiency at existing ports and inorganic expansion along the eastern coastline of India.

The management highlighted its focus on doubling handled volumes over the next five years. This growth will be driven by domestic ports, with volume guidance excluding any potential inorganic opportunities that may arise.

The logistics business is set to drive port volume growth, as the company expands end-to-end services and adopts advanced technology to boost efficiency and reduce turnaround time.

APSEZ has a capex target of INR115b in FY25 (INR40b spent in 1HFY25). Of this, ~INR74b will be allocated to the port business (incl. marine services capex), INR23b to the logistics business, and ~INR15b to renewables (for decarburization), under which the company plans to build 1,000MW of renewable power sources with a combination of both solar and wind.

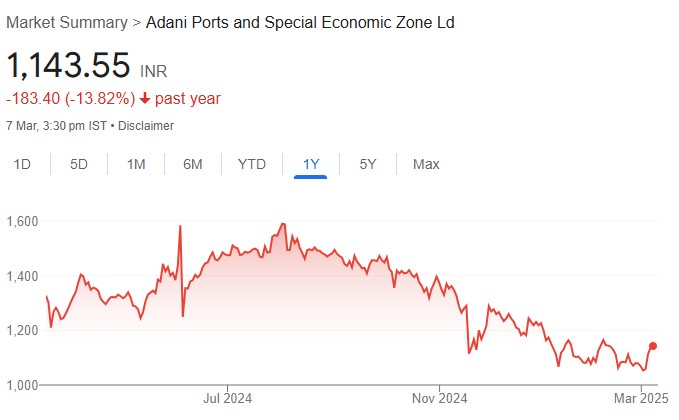

We believe the company is well placed to continue outpacing industry growth and gaining market share. Further, the logistics business will serve as a value addition to the domestic port business, with a focus on enhancing last-mile connectivity. We expect APSEZ to report 10% growth in cargo volumes over FY24-27. This would drive a CAGR of 14%/15%/19% in revenue/EBITDA/PAT over FY24-27. We reiterate our BUY rating with a TP of INR1,400 (premised on 15x Sep’26E EV/EBITDA).

Valuation and view

APSEZ is anticipated to outpace India’s overall growth, driven by a balanced port mix along India’s western and eastern coastlines and a diversified cargo mix. The company continues to invest heavily in the ports and logistics business to drive growth. The commencement of operations at Gopalpur and Vizhinjham Ports will enable the company to further boost volumes.

We expect APSEZ to report 10% growth in cargo volumes over FY24-27. This will drive a revenue/EBITDA/PAT CAGR of 14%/15%/19% over FY24-27. We reiterate our BUY rating with a TP of INR1,400 (premised on 15x Sep-26 EV/EBITDA).