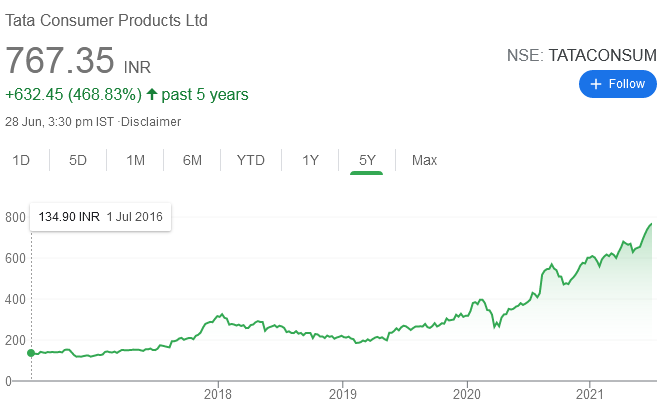

Tata Consumer surges from Rs. 265 to Rs. 765 in 12 months

In hindsight, Gautam Trivedi‘s words were prophetic.

“Tata Consumer Products is the next food and beverages giant in the making“, he had said confidently in April 2020 when advising that we grab the stock with no holds barred.

“Tata Consumer brought in Sunil D’Souza who has done wonders with Whirlpool; the stock of Whirlpool had gone up 3.5x in 5 year. Sunil D’Souza himself had a fantastic background having worked at Pepsi overseas and also the fact that they were merging consumer businesses of Tata Chemicals into Tata Consumer and this is basically going to be a flagship company for the Tata Group as far as consumer business is concerned and interestingly when we bought it was a midcap and it has now become a largecap,” he reiterated in September 2020.

The recommendation was brilliant because Tata Consumer has surged like a supersonic rocket and blossomed from a mid-cap to a large-cap, showering massive gains on its lucky shareholders.

Good to have @trivedi_gautam on @CNBC_Awaaz. His top long bets are #Tataconsumer #HindustanFoods #Aavasfinancier. Gautam likes #AartiInds #NavinFlourine and #Vinatiorganics. Good to have you with us, Sir. @hemant_ghai @YatinMota @SumitResearch

— Shail Bhatnagar (@shail_bhatnagar) September 30, 2020

Focus on stocks bought by PE Funds. They turn into multibaggers

Gautam Trivedi has formulated the theory that stocks which catch the fancy of the mighty Private Equity (PE) Funds have to be in our portfolios as well.

“Private equity funds buying a stake in companies is a big theme for this year, particularly in the midcap space,” he said.

He cited several recent examples like JB Chemicals, Essel Propack, DFM Foods, Dixon Technologies, Amber Enterprises and Hindustan Foods where the entry of the PE Funds has led to a re-rating of the companies and transformed their fortunes.

“The theme that we are seeing in terms of new trends is PE funds. You have seen four this year alone – KKR buying JB Chemicals, Blackstone buying out Essel Propack, Carlyle announced 50 plus percent stake in SeQuent Scientific and earlier this year Advent took over DFM Foods. So you are seeing a lot of that coming up as well and that will increasingly happen to midcap companies where the promoters are either multi-family and second generation wants to go their separate ways … Dixon Technologies is up 3.5 times in the last 12 months, Amber Enterprises has done very well. Hindustan Foods – that is not so much contract manufacturing or electronics but it is more for FMCG which is up 100 percent,” he explained.

SeQuent Scientific is bought by the Carlyle Group

In the latest edition of Outlook Business, Gautam Trivedi has recommended a buy of SeQuent Scientific.

He has pointed out that SeQuent Scientific was carved out from Strides Arcolabs and is India’s largest animal-health company.

It has an annual revenue of over $200 million and is among the top 20 animal health (API and formulations) companies globally.

Animal health APIs account for 35% of its top-line with the balance coming from formulations.

The company employs over 1,700 people; has plants in India, Turkey, Spain, Germany and Brazil; and its products are sold in over 95 countries.

It is notable that SeQuent has the only USFDA-approved animal health facility in India.

Over 90% of its revenue comes from overseas markets with Europe being its largest market, accounting for 55% of revenue.

In August 2020, the Carlyle Group, which has a history of successfully investing in the Indian healthcare space, took control of SeQuent Scientific from the previous owners for Rs 86 a share.

The investment is already yielding mega gains for Carlyle because the stock price has now surged to 293.

This is Carlyle’s largest control deal to date and its first investment in animal healthcare globally, Gautam has added.

He has also pointed out that this will drive their vaccine strategy, an area where they do not have any presence yet, as well as growth in new geographies such as US and China, which are large, untapped markets.

Financials are in a good shape

Gautam has given meticulous details about SeQuent’s financial affairs.

“The company reported stellar Q3FY21 results with revenue up by 13%, EBITDA by 34% and net profits by 83%. EBITDA margins rose nearly 300 bps YoY to 18.2%,” he said.

He also pointed out that SeQuent has announced that it has 35 new formulations under development and plans to make 10 filings in the US over the next three years.

He emphasized that while the company’s net debt-to-equity fell to 0.55x from 2.81x in FY18, its ROCE rose to 21.4% from 7.8% four years ago.

There is a ‘moat’ and ‘barriers to entry’

Gautam has explained that the animal-health space is not only regulated but is also a tough industry because it has to mind varied nuances particular to a region.

There is variability in species within each geography and there are varieties of dosage forms, such as oral, injectable, powder, spot-on and pour-on. Human health, in comparison, is more homogenous, he said.

He also explained that the value addition is in having the last-mile reach and making small but material changes in the generic drugs to enhance its ease-of-delivery for the end-consumer, such as increasing the shelf-life of a medicine vial after it has been opened.

Management under CEO Manish Gupta is top-notch

Gautam Trivedi reposed complete confidence in Sequent’s management.

“The company has top-notch management. There are the best practices brought in by the Carlyle Group but, even more valuable to the company is its CEO Manish Gupta. We place immense faith in Gupta, who has been the company’s CEO since its founding in 2014 and has done an outstanding job steering the company to becoming an Indian MNC,” he said.

I am also impressed by Sequent Scientific MD/CEO, Manish Gupta. A professional Guy, with now the largest stake holder Carlyle Group of US. Its always a nice thing to watch professional managers at the Helm unencumbered by Promoters.

— Rajendra R (@_CreatingWealth) November 1, 2020

(CEO Manish Gupta explains how the animal health industry works)

At the end, Gautam summed up his recommendation in pithy words:

“SeQuent Scientific has recorded stellar financial performance in an industry with wide-moat, and now it has the guidance of a global PE firm“.