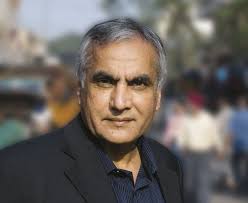

Ajay Relan’s credentials as an ace stock picker stands established by MPS, his stock pick for 2014. In hindsight, Ajay Relan’s analysis was simply brilliant. He urged us to buy the stock with the promise that it is an “inflection” point, meaning that there was no risk of a loss and a potential of a huge gain.

Today, after 300%+ gains, we have to compliment Ajay Relan for his brilliant foresight.

Ajay Relan’s stock pick for 2015, Career Point, appears to be in the same mould. It is a “fallen angel” which is getting its act together. Ajay calls the stock’s valuations “cheap” and has promised 5-bagger returns from the stock in a couple of years.

Now, a close study of Ajay Relan’s analysis of MPS and Career Point shows that he has set out the criteria that he uses to find winning stocks. We need to pay attention to this and try to imbibe it.

In the piece that he wrote for MPS, Ajay Relan indicated that in determining which stock to buy, he looks at the following five value drivers:

(i) One, does the company offer a product or service that has broad acceptability in a large, growing market?

(ii) Two, does the company have healthy margins, and are they sustainable, not just in the short term, but over a longer period of time?

(iii) Three, how efficiently does the company deploy its capital: can it generate significant amounts of cash without resorting to expensive debt?

(iv) Four, does it fritter away the cash generated by the business in making foolish acquisitions or self-aggrandising investments, or does it wisely return the cash to its shareholders by declaring generous dividends?

(v) Fifth, is the company’s management honest and competent, with the hunger to grow the business at a fast clip?

In his piece on Career Point, Ajay Relan has added five more criteria:

(i) Choose companies working in the services sector as opposed to manufacturing, simply because as an economy, India is globally competitive in the services arena;

(ii) Choose companies that can grow and scale up without consuming capital and are aggressive free-cash generators;

(iii) Choose companies whose customers are not other businesses but thousands of consumers, enabling them to have pricing power and resulting in healthy and sustainable profit margins. Such companies will have nurtured a brand that delivers superior service consistently;

(iv) Choose companies whose business is recession-proof and not dependent on the overall growth of the economy;

(v) The overarching criterion is that the stock should be inexpensive with the potential to yield an internal rate of return of, at least, 30% every year over the next four years.

Ajay Relan’s advice makes a lot of sense and we need to diligently implement it in our investment decisions.