A trader named BSEL INFRASTRUCTURE REALTY LIMITED with the nickname ‘CA Team Anamika‘ and handle @BSEINF99 on twitter came into the limelight when it posted screenshots of MTM profit which are verified by sensibull.

The trader is said to be a “Profit Loss Sharing Partnership AIF Fund” with a minimum requirement of Rs 5 Crore.

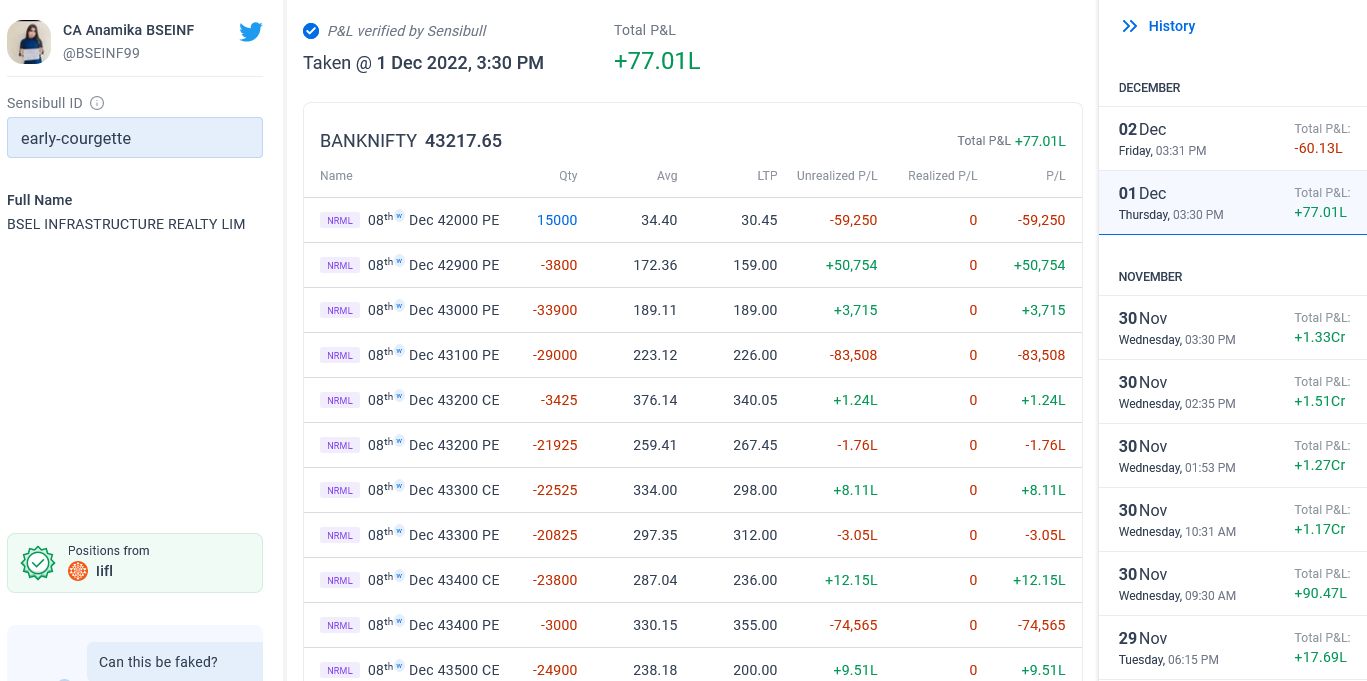

The verified MTM screenshots, posted from 29th November, are quite impressive. The peak profit is Rs 1.51 crore on Wednesday, 30th November. The MTM profit on the preceding three days are Rs 90.47 lakh, Rs 1.17 crore and Rs 1.27 crore. It should be noted that these are not realized profits but are running profits on the open positions.

On the expiry day of 1st December, the profit was Rs 77 Lakh. On 2nd December, there is a loss of Rs 60.13 Lakh.

According to Abid Hassan, the founder of Sensibull, the figures are not the day’s MTM as shown by the broker but is the the accumulated MTM on the open positions at the average cost. It appears this creates a misleading position.

Then you are not verifying PNL for the day. BSEINF99 1.33 Cr for Thursday. On Friday we made profit of 0.77Cr Total profit 2.10Cr. Add 2.68Cr profit (for expiry 08Dec) into your loss of -.60Cr it come profit of 2.08Cr. your figure give misleading picture of profit. Pl correct

— CA Team Anamika (@BSEINF99) December 3, 2022

Anyway, keeping aside the issue of MTM profits, the realized profit for the week ended 1st December 2022 is said to be Rs 2.68 crore. This is, however, not verified.

PNL for weekly expiry ended 01Dec 2022 is 2.68 Crs. Broker IIFL. Client ID BSEINF99. Request Sensibull to capture data and confirm that. pic.twitter.com/PqymGRCG2Z

— CA Team Anamika (@BSEINF99) December 2, 2022

Annual profit is Rs 32 crore on capital of Rs 30 crore

The trader has disclosed that the profit for the 12 months from 2nd Dec 21 till 1st Dec 22 is Rs. 32,24,37,377.65. It is also stated that all Income Tax and other levies are paid and that the data is available online and is open for verification.

Profit for 12 months from 2nd Dec 21 till 1st Dec 22 client ID BSEINF99 Broker IIFL is Rs. 32,24,37,377.65 ps. That is Rs. 32 Cr plus. All Income Tax and other levies paid. Open for verification by any TV Channel, Sensibull, All data's available online pic.twitter.com/dG4GdCriRj

— CA Team Anamika (@BSEINF99) December 2, 2022

As regards the capital deployed in the trade, the trader revealed that the bulk of the capital is by way of margin money obtained by pledging Govt securities, Fixed Deposits and shares. The cash component is very meager and about Rs 1 crore.

This is a very advantageous position to be in because the trader is also earning interest and dividend on the investments. However, it is implied that the brokerage will be high to compensate the broker (IIFL) for putting his own funds into the transactions.

The RoI is about 100%.

30Cr Margin against Govt Securites FD Shares. Cash funds not more than 1 Cr

— CA Team Anamika (@BSEINF99) December 2, 2022

You get 95% on Govt Securites, 90% on FD and shares as per NSDL pledge list hair cut

— CA Team Anamika (@BSEINF99) November 30, 2022

100+%

— CA Team Anamika (@BSEINF99) December 2, 2022

The trader confidently asked Sensibull to verify the data from IIFL.

Sensibull have access to IIFL data. They can access it. If they need authorisation we can provide. They can come online and we will show them on team viewer. They can contact IIFL RM Chirag 9029259124 or me senior manager on 7506990675 for access of data

— CA Team Anamika (@BSEINF99) December 2, 2022

Algo trading, Risk management

It is apparent, given the large volume of trades, that these are driven by computers and algos. The trader confirmed this and also stated that the loss is not allowed to exceed 4% of the margin deployed.

1. Percentage loss never exceed 4% of marign deployed. Computer fires 10000++ trades in a single day. Per trade it will be miniscule..

2. Risk Management rules. Drawdown Max 5%. Drawdown recovery with in 4 working days. ROI 150% ++ per year. Extended ROI 100%++

— CA Team Anamika (@BSEINF99) December 1, 2022

All perfomance made possible

1. Team Inhouse Strategy Experts

2. Tradetron special thanks goes to Umesh CEO and Vikram CTO

XTS platform of Symphony

Again thanks to @Tradetron1

Thanks to all.— CA Team Anamika (@BSEINF99) November 30, 2022

Calendar strategy is adopted

The trader revealed that the Algo implements the Calendar strategy in which the far month option is bought and the near month option is sold.

Yes. Weekly leg squaredup yesterday expiry day with PNL 2.68 Cr. And loss making leg carried forward by sensibull at orignal price rather than previous closing price. If they add 2.68 Cr squp profit. Profit will be much higher.

— CA Team Anamika (@BSEINF99) December 2, 2022

It also appears that the Algo does “short straddles” in which the ATM Call and Put options are sold. Presumably, the position is hedged in the form of an Iron Fly.

Even passive traders can make 80% RoI with the Monthly Calendar strategy

It is worth recalling that Raghunath Reddy, the founder of Opstra, has shown in an interview with Vivek Bajaj‘s F&F show that he earned 80% RoI from the (Monthly) Calendar strategy by making only one adjustment. It is implied that if a passive trader can make 80% RoI from a monthly trade, an active and expert trader would be able to make much more from weekly options and with multiple adjustments. (link)

Retail traders should avoid F&O

The trader sensibly cautioned amateurs and novices not to be carried away by the heady returns and start dabbling in F&O transactions.

“In FNO 90% of retail investors loose 90% of Their capital in 90 days. Please avoid trading in FNO. You can not servive against AK47 type of Robot Algorithm Trading. They fire many bullets at the lightening speed,” he or she rightly warned.

Please note – In FNO 90% of retail investors loose 90% of Their capital in 90 days. Please avoid trading in FNO. You can not servive against AK47 type of Robot Algorithm Trading. They fire many bullets at the lightening speed.

— CA Team Anamika (@BSEINF99) December 2, 2022

Good for knowledge

too good to be true, lets when the the true colours open up, till then stay cautious