Profitability focus at the fore…

About the stock: Alivus life sciences (erstwhile Glenmark life sciences) is a leading developer and manufacturer of APIs (~93% of FY25 revenues) with major focus in chronic therapeutic areas such as cardiovascular disease, central nervous system disease, pain management and diabetes. GLS caters to over 700 customers in more than 75 countries with a product basket of +150 products.

• The company is also into CDMO services (~7% of FY25 revenues) catering to a range of multinational and specialty pharmaceutical companies.

• It owns a total reactor capacity of ~1424 KL (1198KL API & 226 KL Backward Integrated) with manufacturing facilities at Ankaleshwar, Dahej in Gujarat and Mohol, Kurkumbh in Maharashtra.

Result performance & Investment Rationale:

• Q3FY26 – Inline numbers with better margins – Revenues grew ~6% on a YoY basis to ₹662.6 crore, driven by Glenmark API sales, which grew ~14% on a YoY basis to ₹201.8 crore and CDMO business which grew 85% YoY to ₹55.6 crore. The growth was neutralized by the non-GPL API business, which de-grew 3.4% YoY to ₹405.2 crore due to higher sales in earlier quarters (9M growth ~17%). EBITDA grew 21.6% YoY to ₹ 231.3 crore with margins of 34.4% (up 472 bps YoY) driven by 337 bps improvement in GPM (58.9%) and better cost control. PAT grew ~10% YoY to ₹150.3 crore.

• Higher margin guidance based on product-specific strategy- While the revenues were in line, margin expansion was a positive surprise led by strong CDMO traction and higher proportion of new product sales. GPL growth was back on track as the inventory de-stocking phase was more or less over. CDMO growth was driven by solid traction from the fifth project and better offtake from existing contracts. For FY26 the management has reiterated its high single-digit revenue growth guidance but has increased the EBITDA guidance from 28-30% to 30-32% range.

• Capacity expansion, CDMO momentum to steer growth beyond FY26- The company is planning to add significant capacities (from 1424 KL to 2690 KL) by FY28 with a full liberty for capex from the new promoters. Almost 400 KL is expected to be added for backward integration. With augmented capacities and a growing basket of products we believe the company is well poised to accelerate growth for FY27 and beyond. Key monitorable would be the pricing pressure as company continue to grow it volume in mid double digit however reported growth is expected to be single digit owing to pricing pressure of ~4-5%. We believe the overall prospects remain promising on account of focus on profitability and calibrated capex despite slight volatility in revenues. Alivus remains a compelling bet in the APIs space with strong execution prowess and a healthy balance sheet.

Rating and Target price

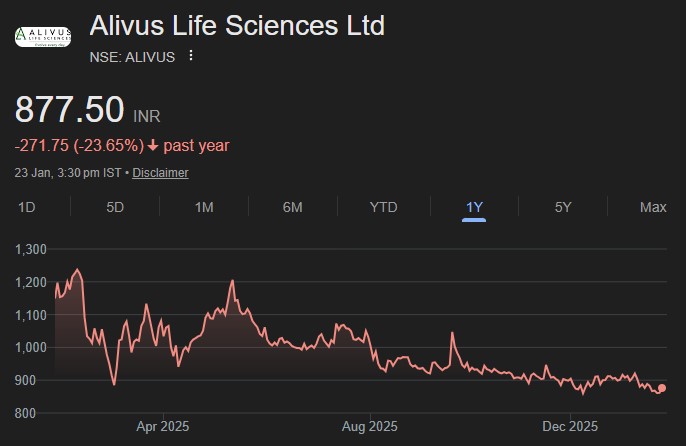

• We value Alivus life sciences at ₹ 1190 based on 14x FY28E EBITDA of ₹1024 crore.