Amitabh Bachchan’s good luck on the Box office continues on the bourses as well. In a fine detective work, the Economic Times, relying on Jaya Bachan’s parliamentary disclosures, dug out the Big B’s stock portfolio. What is heartening to know is that Amitabh Bachchan’s stock portfolio has managed to keep its head above water despite all the carnage happening in the stock markets.

His choice of stocks does not come as a big surprise. In keeping with his calm and dignified personality, the Big B has steered clear of capital goods stocks, realty and rate sensitive sectors. Instead, the super-star has tanked up on “boring” chemical companies stocks, which can be relied upon to churn out regular returns year after year, even though they may not set the stock markets on fire.

However, even here, one noteworthy aspect is that Amitabh Bachchan has not put his wealth into the trusted war horses like Tata Chemicals or Rallis but has instead banked on a relatively unknown newcomer called Fineotex Chemicals. Fineotex Chemical is promoted by the Tibrewala family and is in the business of manufacturing specialty chemicals and enzymes.

Fineotex came out with an IPO in Feb 2011 at the price of Rs. 72 per share. Unlike other IPO stocks which languished, it soared to a high of Rs. 353 on 28th June 2011, giving the IPO subscribers a multi-bagger within just a few weeks.

Sadly, after that it has been a one way ride down for Fineotex. Fineotex is presently quoting in the 90s, still much above its IPO price but far away from its all-time high of Rs. 353.

ET reported that Amitabh Bachchan bought a big chunk of 3 lakh shares of Fineotex Chemicals between Rs. 170 to Rs. 150 per share.

Amitabh Bachchan’s fascination for the young-gen stocks shows in his next stock pick as well: Birla Pacific Medspa. This company came out with its IPO in July 2011 and thrilled investors by soaring to a high of Rs. 30 on the opening day itself. Birla Pacific Medspa’s business model is unique and with no competitors in the listed space. The Big B must be banking on Birla Pacific Medspa touching a chord with the young upper middle class population of the Country.

ET also pointed out that Amitabh Bachchan had holdings in yet another unknown company called Neuland Labs.

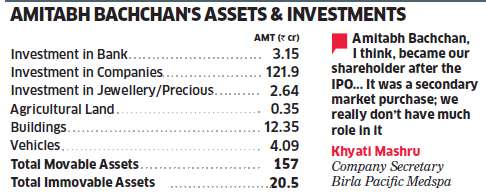

Interestingly, Amitabh Bachchan has put a lot of his money in stocks. Out of a total net worth of Rs.177 crores, the Big B has a whopping Rs. 122 crores (69%) in stocks. Talk about being a concentrated investor!

Sadly, while Amitabh must have been raking in the big bucks with his old stock picks, the new stock picks haven’t yet set the cash registers ringing. Fineotex Chemicals has slumped to a low of Rs. 92 while Birla Pacific Medspa is close to its IPO price. He has also lost heavily in Reliance Power. He bought the shares of Reliance Power at the time of the IPO for Rs. 430 per share (the price would be lower owing to the bonus) and that is currently languishing at Rs. 90 with no buyers in sight.

ET also reported that Amitabh Bachchan has investments in most Sensex stocks and other midcap companies. He apparently prefers stocks in the education, media & entertainment, FMCG and healthcare sectors because these have the most potential. We are sure one of his big holdings must be IPCA Laboratories, owned by his brother Ajitabh Bachan. IPCA Laboratories is now on the Buy list of most brokerages owing to its steady and stellar performance.

Amitabh Bachchan’s Stock Portfolio

[download id=””]

Sir,

Neuland lab is long term very very good bat, other long term stocks we can advise you,if you require contact on +91 9825056396