Riding India’s data center localization wave

RE business to grow steadily, while DC & Cloud will be in the limelight

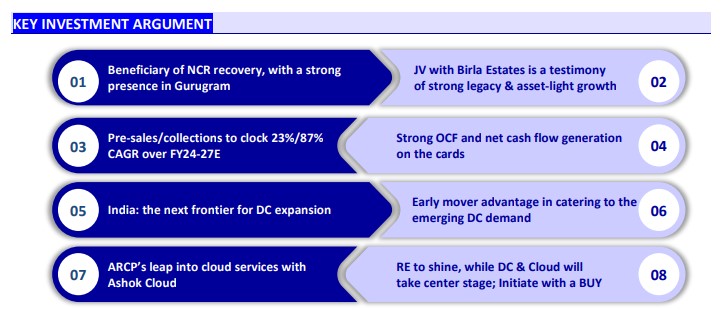

Diversification in progress…: Anant Raj (ARCP) is transitioning from its stronghold in real estate to a diversified business model with strategic investments in data centers (DCs) and cloud services. This shift capitalizes on India’s burgeoning data localization and digital transformation trends. With a planned capacity of 300MW for DC over the next 4-5 years, the company is leveraging its existing technology parks to enhance execution speed and cost efficiency.

…with intense focus on profitability: ARCP’s foray into higher-margin cloud services (IaaS) in partnership with Orange enhances its profitability potential, with cloud capacity projected to rise to 25% by FY32. Its residential business remains robust, with 14msf deliveries expected by FY30, generating a cumulative NOPAT of INR85.1b.

Multiple growth levers at play: Strong pre-sales, collections, and operational cash flows underpin ARCP’s growth. While execution risks remain, we expect significant revenue and EBITDA margin expansion, driving long-term value creation. We initiate coverage on the stock with a BUY rating and a TP of INR1,100.