What is Raghav Productivity Enhancers?

Raghav Productivity Enhancers Ltd is a small-cap stock with a market capitalisation of Rs 1038 crore. It is the world’s largest manufacturer of Silica Ramming Mass. It offers customized lining solutions for secondary steel producers and foundries, enabling non-linear productivity growth and massive reduction in power & overhead costs for its clients. As it is the only organized player in this industry, its products are significantly expensive than the market, However, They reduce costs of clients by at-least 5 times the cost of its product, effectively making its products not just free but massively profitable for its clients.

The Company is listed only on the BSE and has been placed under the ‘ASM ST : Stage 1’ (Advanced Surveillance Mechanism), which means that there are restrictions on the purchase and sale of the stock and on the price movement.

The promoters hold 69.61% while the public holds 21.49%. There are no Mutual Funds holding the stock.

The fundamentals of the stock are as follows:

Raghav Productivity Enhancers Ltd – Key Fundamentals

| Parameter | Values | ||

| Market Cap | (Rs cr) | 1,038 | |

| EPS – TTM | (Rs) | [*S] | 20.07 |

| P/E Ratio | (X) | [*S] | 47.53 |

| Face Value | (Rs) | 10 | |

| Latest Dividend | (%) | 5.00 | |

| Latest Dividend Date | 15 Jul 2022 | ||

| Dividend Yield | (%) | 0.10 | |

| Book Value / Share | (Rs) | [*S] | 111.09 |

| P/B Ratio | (Rs) | [*S] | 8.59 |

[*C] Consolidated [*S] Standalone

Raghav Productivity Enhancers Ltd – Financial Results

| Particulars (Rs cr) | Sep 2022 | Sep 2021 | % Chg |

| Net Sales | 35.88 | 23.88 | 50.25 |

| Other Income | 0.11 | 0.76 | -85.53 |

| Total Income | 35.98 | 24.64 | 46.02 |

| Total Expenses | 27.07 | 18.2 | 48.74 |

| Operating Profit | 8.92 | 6.44 | 38.51 |

| Net Profit | 6.17 | 4.35 | 41.84 |

| Equity Capital | 10.88 | 10.88 | – |

(Source: Business Standard)

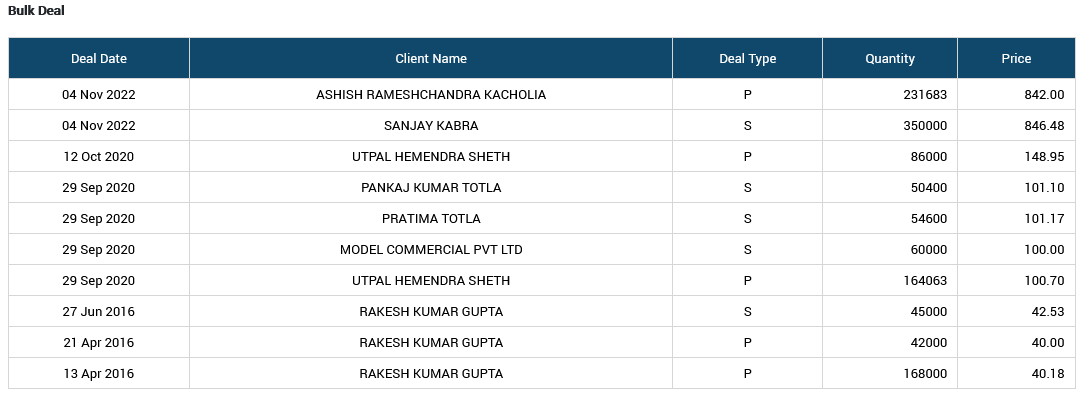

Ashish Kacholia bought 231683 shares at Rs 842 each from the promoter

Utpal Sheth has been steadily buying the stock of Raghav Productivity Enhancers. He bought a tranche of 164063 shares on 29th Sept 2020 at Rs 100.7. He added 86000 shares on 12th Oct at Rs. 148.98. He presently holds 394711 shares comprising 3.63% of the equity capital.

Ashish Kacholia bought 231683 shares of Raghav Productivity Enhancers on 4th November 2022 at Rs 842 per share in a bulk deal. The seller was Sanjay Kabra, one of the promoters.

Ashish Kacholia’s portfolio holdings is now worth Rs 1920 crore

The other shares held by Ashish Kacholia is as follows. The portfolio is worth Rs 1920 crore.

| Stock | Value (Rs Cr) | Nos of shares held | ||||

| Safari Industries (India) Ltd | 111.2 | 614,288 | ||||

| Shaily Engineering Plastics Ltd. | 110.0 | 599,696 | ||||

| Fineotex Chemical Ltd. | 99.3 | 2,924,072 | ||||

| PCBL Ltd. | 91.2 | 7,056,173 | ||||

| NIIT Ltd. | 88.2 | 3,000,000 | ||||

| Rainbow Childrens Medicare Ltd. | 84.4 | 1,044,211 | ||||

| Ami Organics Ltd. | 76.2 | 776,474 | ||||

| La Opala RG Ltd. | 72.6 | 1,767,433 | ||||

| Vaibhav Global Ltd. | 69.2 | 2,000,000 | ||||

| Hindware Home Innovation Ltd. | 66.0 | 1,926,788 | ||||

| Garware Hi-Tech Films Ltd. | 65.3 | 924,577 | ||||

| Barbeque-Nation Hospitality Ltd. | 62.7 | 557,510 | ||||

| Xpro India Ltd. | 58.1 | 779,350 | ||||

| Aysil Ltd. | 55.7 | 1,000,000 | ||||

| Best Agrolife Ltd. | 54.4 | 345,392 | ||||

| Gateway Distriparks Ltd. | 53.8 | 1,917,606 | ||||

| Arvind Fashions Ltd. | 53.5 | 1,456,054 | ||||

| SJS Enterprises Ltd. | 53.0 | 1,169,839 | ||||

| Gravita India Ltd. | 49.5 | 1,351,649 | ||||

| Yasho Industries Ltd. | 48.5 | 296,322 | ||||

| IOL Chemicals and Pharmaceuticals Ltd. | 42.6 | 1,153,566 | ||||

| Faze Three Ltd. | 41.7 | 1,238,708 | ||||

| Beta Drugs Ltd. | 40.4 | 550,000 | ||||

| Ador Welding Ltd. | 39.0 | 437,700 | ||||

| Stove Kraft Ltd. | 35.3 | 576,916 | ||||

| Shankara Building Products Ltd. | 32.9 | 451,140 | ||||

| Genesys International Corporation Ltd. | 32.1 | 618,734 | ||||

| D-Link (India) Ltd. | 31.5 | 1,186,350 | ||||

| Agarwal Industrial Corporation Ltd. | 25.5 | 372,128 | ||||

| TARC Ltd. | 24.0 | 5,477,157 | ||||

| Bharat Bijlee Ltd. | 22.4 | 101,350 | ||||

| Repro India Ltd. | 20.5 | 457,962 | ||||

| Inflame Appliances Ltd. | 18.0 | 308,000 | ||||

| Sastasundar Ventures Ltd. | 17.9 | 598,902 | ||||

| United Drilling Tools Ltd. | 17.5 | 570,817 | ||||

| eative Newtech Ltd. | 16.8 | 340,101 | ||||

| ADF Foods Ltd. | 16.2 | 227,605 | ||||

| HLE Glasscoat Ltd. | 13.3 | 191,602 | ||||

| Moongipa Securities Ltd. | 5.8 | 301,000 | ||||

| Megastar Foods Ltd. | 3.0 | 103,666 | ||||

| CHD Developers Ltd. | 0.43 | 6,361,166 | ||||

| Total | 1919.63 | |||||

| Stocks earlier held in the portfolio by Ashish Kacholia | ||||||

| Mastek Ltd. | – | – | ||||

| Mold-Tek Packaging Ltd. | – | – | ||||

| Vishnu Chemicals Ltd. | – | – | ||||

| VRL Logistics Ltd. | – | – | ||||

| Kwality Pharmaceuticals Ltd. | – | – | ||||

| Astec Lifesciences Ltd. | – | – | ||||

| Caplin Point Laboratories Ltd. | – | – | ||||

| Igarashi Motors India Ltd. | – | – | ||||

| Birlasoft Ltd. | – | – | ||||

| Marksans Pharma Ltd. | – | – | ||||

| Neuland Laboratories Ltd. | – | – | ||||

| Poly Medicure Ltd. | – | – | ||||

| Religare Enterprises Ltd. | – | – | ||||

| Venus Remedies Ltd. | – | – | ||||

| Aurum Proptech Ltd. | – | – | ||||

| DFM Foods Ltd. | – | – | ||||

| Apollo Pipes Ltd. | – | – | ||||

| Paushak Ltd. | – | – | ||||

| Apollo TriCoat Tubes Ltd. | – | – | ||||

| Mahindra Logistics Ltd. | – | – | ||||