About PSP Projects

PSP Projects is a small-cap company with a market capitalisation of Rs 2500 crore. The Free Float is Rs 763 crore. Its salient features can be summed up as follows:

(i) It was incorporated in 2008, successfully led by Prahladbhai Patel, a first generation civil engineer having 36 years of experience.

(ii) It is an India based construction company offering a diversified range of construction and allied services across industrial, institutional, government, government residential, residential projects and precast.

(iii) It is an integrated EPC company across construction value chain from Design, Construction, Mechanical, Electrical, Plumbing (MEP), Interior, O&M Services.

(iv) It is geographically diversified with presence in six states viz. Gujarat, Rajasthan, Karnataka, Uttar Pradesh, Maharashtra and New Delhi.

(v) It was listed on NSE and BSE on May 29, 2017, raising Rs.211.68 crore.

(vi) In December 2021, it commissioned Precast facility in Gujarat with the objective to provide Sustainable Building Solutions and Technological Upgradation.

A study of the 5-year FY17-FY22 financial records shows impressive results. The Revenue from Operations grew at 34.27% CAGR. The EBITDA grew at 31.22% CAGR while the PAT grew at 31.21%.

The Order Book of PSP Projects stands at the highest ever level of Rs.5,081 crore. In comparison to all previous H1, the company has received highest ever order inflow of Rs.1,512 crore in H1FY23 as compared to Rs.637 crore during H1FY22, a growth of 137% year on year.

There were 14 projects awarded during the quarter:

1. Corporate Office Building Project by a leading multi-national company of value Rs.290 crore.

2. Repeat order in Precast for National High-Speed Project from L&T of value Rs.195 crore

3. Fore Court Development at Ahmedabad Airport of value Rs.128 crore

4. Repeat order to construct Phase II of Noodle plant by a leading multi-national company of value Rs.115 crore.

5. Repeat order to construct manufacturing unit by a leading pharmaceutical company of value Rs.99 crore

6. Archaeological museum of value Rs.97 crore awarded by Government of Gujarat.

During Q2FY23, completed 10 projects which includes High rise commercial building in GIFT city, Corporate office building for Indian Potash Limited, Four Precast projects, medical college & hospital in Rajasthan, etc.. All the projects were completed in time. Total projects completed till date totals to 196 projects.

#OnCNBCTV18 | Expect further ₹500-1,000 cr order inflow in this current fiscal. Targetting a 50:50 order break-up with respect to government & private. Did not accept SRA Chandivali order, says P.S Patel of PSP Projects pic.twitter.com/Nix3eoglzD

— CNBC-TV18 (@CNBCTV18Live) December 13, 2022

Key Fundamentals and Financials

The key Fundamentals and financials of PSP Projects are as follows:

Key Fundamentals

| Parameter | Values | ||

| Market Cap | (Rs cr) | 2,544 | |

| EPS – TTM | (Rs) | [*S] | 42.26 |

| P/E Ratio | (X) | [*S] | 16.72 |

| Face Value | (Rs) | 10 | |

| Latest Dividend | (%) | 50.00 | |

| Latest Dividend Date | 19 Sep 2022 | ||

| Dividend Yield | (%) | 0.71 | |

| Book Value / Share | (Rs) | [*S] | 199.49 |

| P/B Ratio | (Rs) | [*S] | 3.54 |

[*C] Consolidated [*S] Standalone

Financial Results

| Particulars (Rs cr) | Sep 2022 | Sep 2021 | % Chg |

| Net Sales | 359.98 | 390.44 | -7.8 |

| Other Income | 6.28 | 4.39 | 43.05 |

| Total Income | 366.27 | 394.83 | -7.23 |

| Total Expenses | 320.51 | 335.73 | -4.53 |

| Operating Profit | 45.76 | 59.09 | -22.56 |

| Net Profit | 21.52 | 36.34 | -40.78 |

| Equity Capital | 36 | 36 | – |

(Source: Business Standard)

Sunil Singhania’s Abakkus Fund already holds stake. Ashish Kacholia’s Himalaya buys stake in bulk deal

As already stated, the promoters hold 70.45% of the equity while the Public holds 29.55%. Out of the market capitalisation of Rs 2500 crore, the Free Float is Rs 763 crore.

A Mutual Fund named IDFC LARGE CAP FUND holds 8,96,711 shares comprising 2.49 of the equity.

Sunil Singhania‘s ABAKKUS EMERGING OPPORTUNITIES FUND-1 holds 5,45,000 shares comprising 1.51% of the equity. Of this, a tranche of 445000 shares was purchased on 27th September 2021 at the price of Rs 425.68.

A FII named ICG Q LIMITED holds 4,36,568 shares comprising 1.21% of the equity.

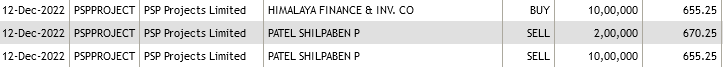

Yesterday, Himalaya Finance & Investment Co, the investing arm of Ashish Kacholia, bought 10,00,000 shares in a bulk deal at Rs 655.25 per share. The seller was Shilpaben Patel, one of the promoters.

The total investment by Ashish Kacholia in PSP Projects is Rs 65.50 crore.

Research Reports

ICICI Securities has pointed out that PSP’s share price has grown at ~6% CAGR over the past five years (from Rs 419 in October 2017 to Rs 571 levels in October 2022). They have recommended a BUY for the target price of Rs 720.

The key triggers for future price performance are the following:

► PSP’s pre-qualification for public projects would rise to Rs 2,500+ crore with the completion of the Surat Diamond Bourse (SDB) project. Addition of big ticket sized project is expected to boost its overall order book position

► Significant traction and orders for pre-cast facility is likely to bring incremental benefits and associated revenue

► Expect revenue, earning CAGR of 15.3%, 6.9%, respectively, in FY22-24E

The Key Risks are: (i) Delay in execution of key projects; (ii) Significant increase in commodity prices