About Likhitha Infrastructure

Likhitha Infrastructure is named after Mrs. Likhitha Gaddipati, the promoter and Chief Financial Officer of the Company. She has a Master’s in Information Technology and Management from Illinois Institute of Technology,USA and has vast experience in finance and project management.

She is related to Mr. Srinivasa Gaddipati Rao, the Managing Director and founder of the company. He has vast technical experience of over three decades in the Oil & Gas Infrastructure business and is the guiding force behind the successful execution of business strategies over the years. The Company has grown during the past under his leadership and guidance. He has exposure in all business verticals and is engaged in supervision & conduct of the business of the Company, along with a team of senior management personnel, who assist him in carrying out his activities, subject to the overall supervision & control of the Board of Directors. The meteoric rise of this Company and its success is hugely attributed to him.

Likhitha is a small-cap with a market capitalisation of Rs 911 crore. The Free Float is about 236.89 crore.

It was incorporated in 1998 and is an oil & gas pipeline infrastructure service provider, focused on laying pipeline networks along with the construction of associated facilities and providing operations & maintenance services to the city gas distribution (CGD) companies in India.

The Company has successfully laid over 1500 km of steel pipelines and over 1500 km of MDPE of oil & gas pipelines in the past years. Additionally, the company is laying approximately 1000 km of oil & gas pipelines for the ongoing projects.

The Company executed the First Trans-National cross-country pipeline of South-East Asia connecting India to Nepal in the year 2019, for the supply of petroleum products.

It has a strong client base consisting of leading gas distribution companies in India, including both the private & public players. It is certified under ISO 9001:2015 for specialization in the field of Design, Construction of Cross-country pipelines, City Gas Pipelines, and associated facilities.

The Company has an excellent track record of timely execution of projects in all business areas with quality & client satisfaction.

The Promoters hold 74% while the Public holds 26%. The Company is Debt-free.

Key Fundamentals & Financial Results

Key Fundamentals

| Parameter | Values | ||

| Market Cap | (Rs cr) | 911 | |

| EPS – TTM | (Rs) | [*S] | 13.50 |

| P/E Ratio | (X) | [*S] | 17.11 |

| Face Value | (Rs) | 5 | |

| Latest Dividend | (%) | 10.00 | |

| Latest Dividend Date | 16 Sep 2022 | ||

| Dividend Yield | (%) | 0.22 | |

| Book Value / Share | (Rs) | [*S] | 55.37 |

| P/B Ratio | (Rs) | [*S] | 4.17 |

[*C] Consolidated [*S] Standalone

| Particulars (Rs cr) | Sep 2022 | Sep 2021 | % Chg |

| Net Sales | 82.96 | 58.81 | 41.06 |

| Other Income | 1.28 | 0.96 | 33.33 |

| Total Income | 84.24 | 59.77 | 40.94 |

| Total Expenses | 63.24 | 45.16 | 40.04 |

| Operating Profit | 21 | 14.61 | 43.74 |

| Net Profit | 14.6 | 10.38 | 40.66 |

| Equity Capital | 19.73 | 19.73 | – |

(Source: Business Standard)

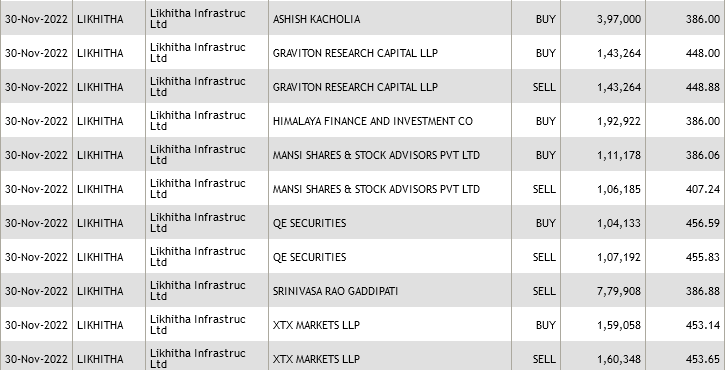

Ashish Kacholia bought shares at a premium price

In a bulk deal on the NSE of 30th November 2022, Ashish Kacholia bought 3,97,000 shares of Likhitha at Rs 386. His investment company named Himalaya Finance & Investment Co bought 1,92,922 shares at the same price. The total purchase of 5,89,922 shares is worth Rs 22.77 crore.

Srinivasa Gaddipati Rao, the promoter-founder, sold 7,79,908 shares at Rs 386.88.

Investors’ Presentation

The latest Investors’ Presentation sheds valuable light on the business model of the Company and its future prospects. It is stated that the Company has a strong track record of executing oil and gas projects and that it has an asset ligt model and a high margin business. It is also stated that there are entry barriers due to complexity of the business. There is high potential for growth.