We believe Swiggy and Eternal will continue to dominate the food delivery business. On...

Arjun

360ONE offers a compelling structural growth story anchored in India's expanding wealth and asset...

LTIM is now in a unique position, wherein it is trading below the expensive...

We initiate coverage of Cera Sanitaryware Ltd. with a BUY recommendation and a target...

Vishal Mega Mart (VMM) is one of India’s largest offline-first value retailers, catering to...

Kalyan Jewellers was founded by T S Kalyanaraman – who has over 45 years...

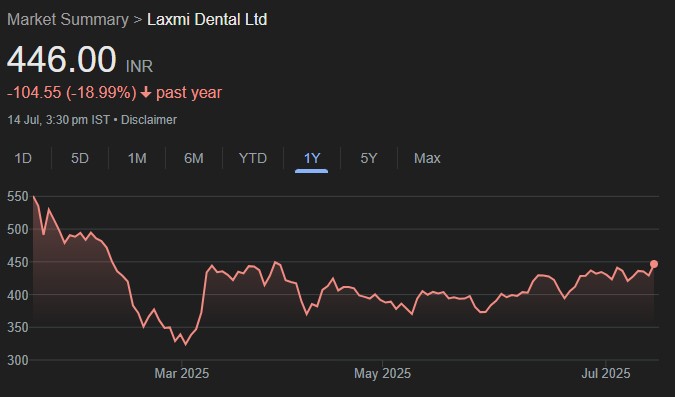

Laxmiden’s business encompasses three high-growth pillars: custom labs (crowns and bridges), aligner solutions (clear...

At 23.6x 1-year forward multiple, TCS trades at a 4% discount to its average...

Abbott’s core portfolio productivity is the highest in the industry — at Rs 12.5mn...

We reiterate BUY on Anant Raj with an unchanged TP of Rs800. The company...