PVR Inox’s ad revenue grew ~36% QoQ to ~INR 1.48bn (highest quarterly ad-income post...

Arjun

For this report emphasis was on finding value buys having regard to probable turnaround...

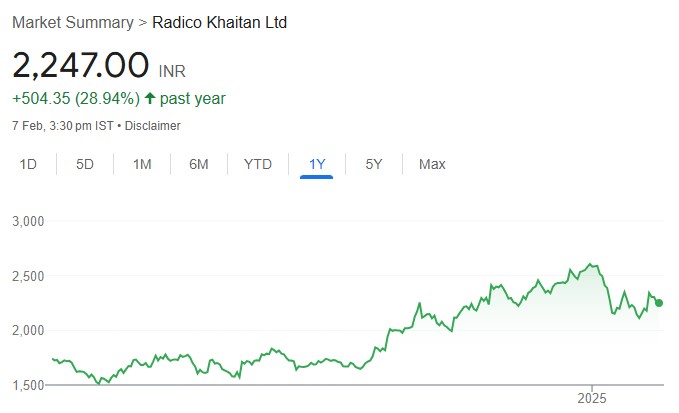

We continue to maintain Radico as a high-conviction BUY with a target price of...

For Aditya Birla Sun Life AMC Ltd, we expect 12-15% YoY growth in AUM...

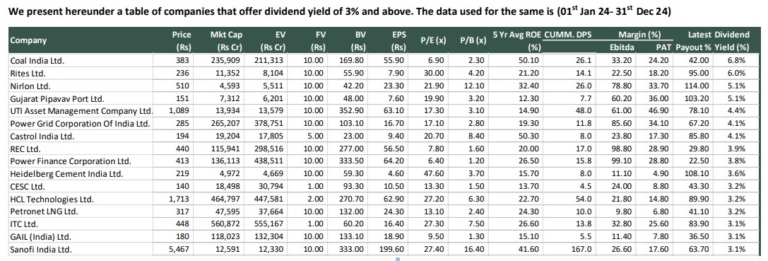

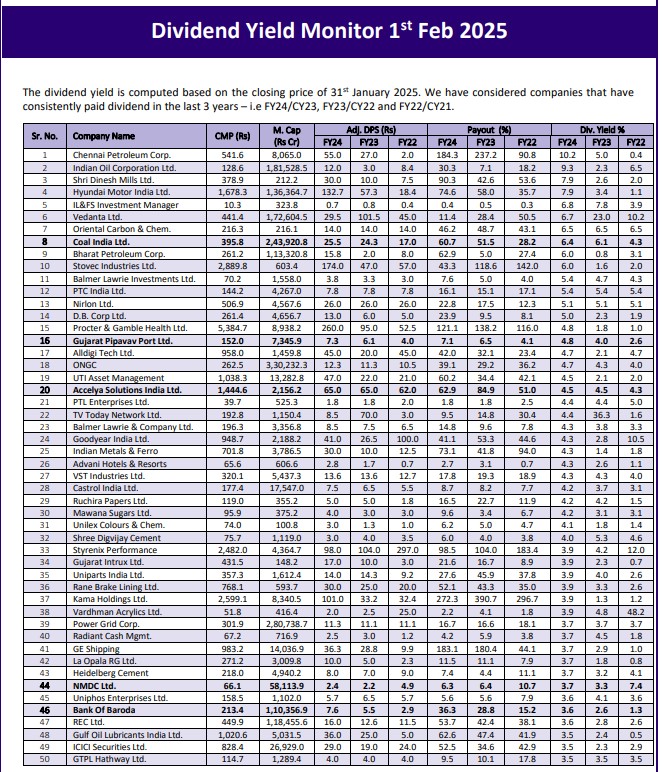

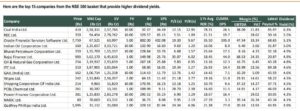

Selection criteria – Market cap should be more than 500 Cr, Dividend yield should...

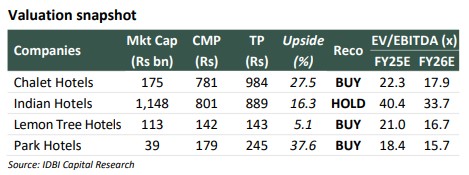

New hotels addition continued at healthy pace: The organized players continued to add new...

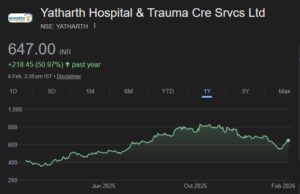

The company has strong balance sheet with net cash of ₹750 cr+. Asset light...

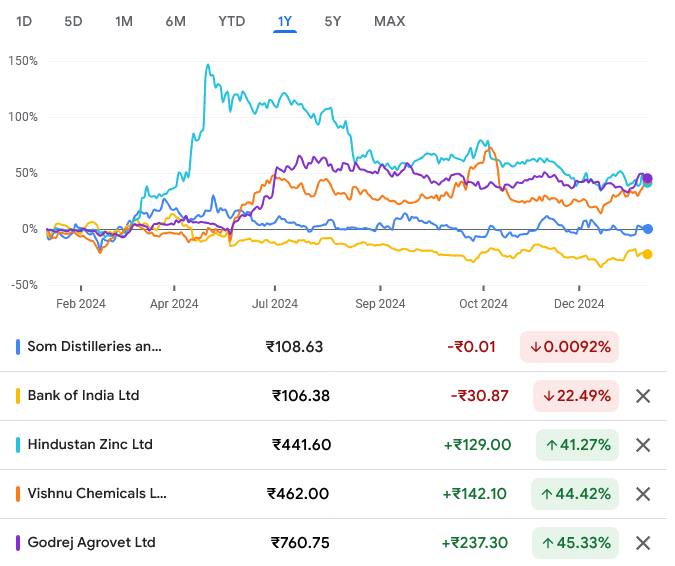

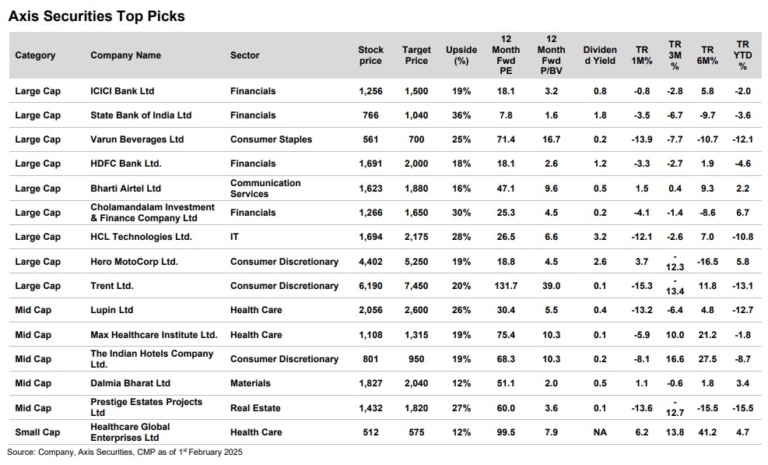

Axis Top Picks Basket delivered excellent returns of 12% in the last year against...

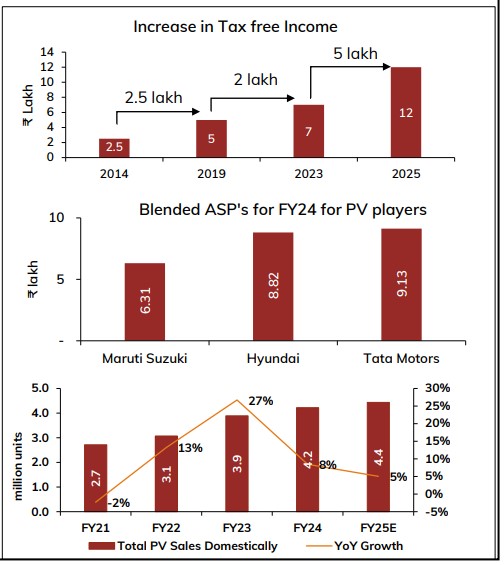

The Government in Budget 2025-26 has tried to balance the three cornerstones of the...

The dividend yield is computed based on the closing price of 31st January 2025....