We recently met with MCX management. We gained more confidence in their strategic direction,...

Arjun

Archean Chemical Industries Ltd (ACIL) is the leading player in marine speciality chemicals manufacturing...

SENCO is one of the most promising players in the organized retail jewelry market....

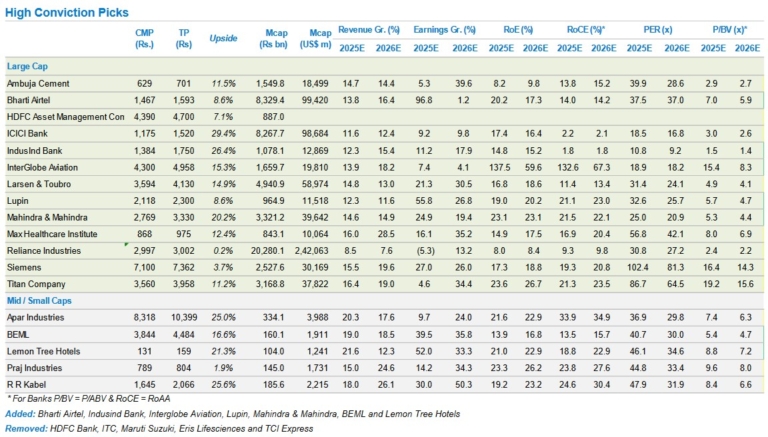

NIFTY target increased to 26820 + 18 High Conviction Model Portfolio of Large & Mid-Cap stocks by PL

Model Portfolio: We are cutting weights on ICICI, KMB, Maruti, ABB, L&T, HDFC AMC...

Mphasis has rallied 25% in the last three months, fuelled by expectations of interest...

Favorable market dynamics, flex seat demand to grow at 23.3% CAGR over 2023-26E, led...

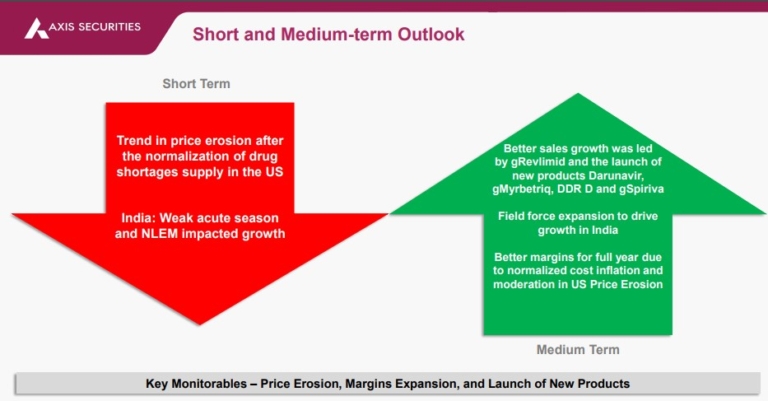

In Q1FY25, the Pharma Coverage universe posted robust revenue growth of 11%/4% YoY/QoQ, driven...

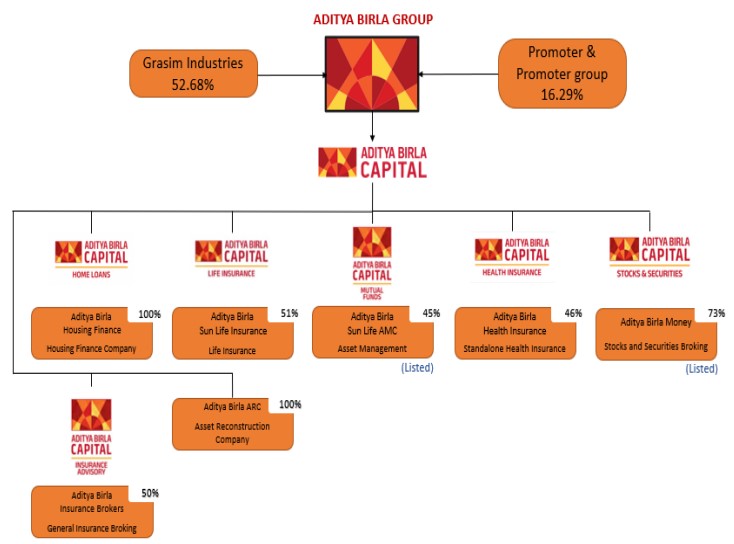

Aditya Birla Capital Limited (ABCL) is a diversified financial services group that operates in...

Incorporating revised earnings, our estimates don't undergo any major change. We value Nifty at...

APL Apollo Tubes (APAT) during the quarter reported 9.4%/-0.2% YoY increase in Net sales/PAT...