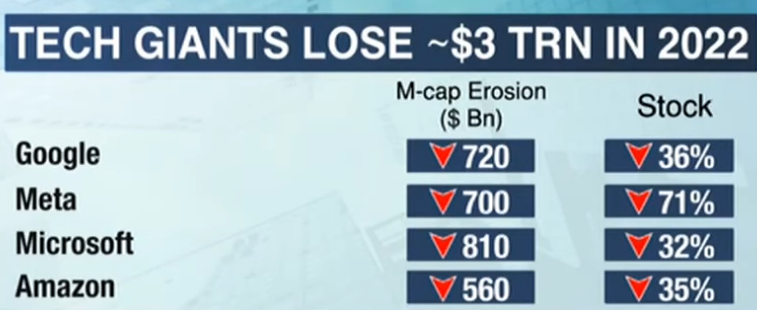

US Tech stocks have plunged because of the recession. Indian Tech stocks will also plunge

“I am still bearish on the IT sector and just the example of what has happened to US tech companies and their earnings over the last one week is a testimony of what could happen for our IT companies in Q3 and Q4. Markets anticipate a slowdown and when the actual numbers come, we see some more correction“, Sridhar Sivaram said in a grim tone.

He pointed out that Indian Tech stocks are dependent on global tech spending. As Europe and USA will enter a recession sometime next year, there will be a slowdown.

He opined that the fourth quarter of the fiscal year 2022-23 could be the bottom for the IT sector because that is when there will be serious downgrades.

Sridhar noted that though stocks have corrected, earnings expectations have not yet corrected that much. When the earnings expectations also correct (probably in the fourth quarter), the stock prices will correct more, he warned.

The banking system is witnessing a “Cinderella moment”

“We are very bullish on the largecap banks,” Sridhar boldly declared.

He explained that credit costs have started to significantly normalise and are now even lower than the pre-Covid levels. Banks which are able to collect CASA and deposits in a tight liquidity situation and in a rising interest rates environment will do very well.

“Credit cost is the big thing and we are seeing loan growth coming back and we could see significant earnings upgrades coming over the next two to three, six quarters“.

“We have been very bullish on the banking space. Just buy any of them and you could make lot of money over the next three years. It is the Cinderella moment for the banking system,” he added.

Sridhar also made it clear that we need not fuss about whether to buy HDFC Bank or ICICI Bank or any other Bank.

“It does not matter whether it is HDFC Bank or ICICI, it is just all the banks look extremely good,” he said.

He also gave a clean chit to the PSU Banks. “Some of them may have technical issues but over a period these will get ironed out. Maybe even some of the top three-four PSU banks because all of them look extremely good right now,” he said.

Just buy a financial services ETF or Mutual Fund

Sridhar advised investors who are confused about whether to buy Private or PSU Banks or large-cap or mid-cap Banks to just simply buy a financial services ETF or Mutual Fund.

“The easiest way of buying banks which have the advantage of garnering a good CASA or deposit franchiseis is to just buy a financials mutual fund. One does not need to have a lot of cash,” he said.

“These banks could give you easily 20% compounded over the next three-four years. If the Cinderella moment which Mr Uday Kotak is talking about continues and which we think is very much possible,” he added.

Taking a cue from Sridhar Sivaram, we can buy any of the Bank Nifty ETFs which are trading on the stock market. These are extremely low cost and also very liquid and replicate the Nifty Bank Index. We get a readymade mix of large-cap and mid-cap and also private and PSU Banks.

The constituents of Nippon India ETF Bank BeES as on 31st July, 2021 are the following: