The Axis Top Picks Basket delivered an excellent return of 11.8% in the last three months against the 7.5% return posted by Nifty 50 over the same period. This implies that the Axis Top Picks Basket beat the benchmark by a wide margin of 4.3%. Moreover, the basket inched up by 5.8% in the last one month. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 306% since its inception (May’20), which stands well above the 159% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection.

FY25 – Good Start but Volatile Path Ahead; Macro to Remain at the Center: Nifty reached an all-time high of 24,045 on 27th Jun’24. This impressive growth was driven by several factors including 1) Positive development towards NDA 3.0, 2) Continued focus on CAPEX and Infrastructure development, 3) Improved sentiments towards policy continuity, 4) Strong domestic inflows, 5) Valuation comfort after the correction, and 6) Inline Q4FY24 earnings season. The Jun’24 was nonetheless an interesting month for the overall equity market. On June 4th, an unexpected surge in the number of votes in favour of the “India alliance” – no exit poll the day prior expected anything close to the actual voting pattern – caused a sharp and negative market reaction, with the Nifty 50 dropping by 6% and the India VIX jumping 28%. The ruling NDA faced tough competition but ultimately was able to form a coalition government, led by Prime Minister Narendra Modi for a third term. Later during the month, no major surprises were seen for the ministry allocation in the NDA 3.0 government. This sends a clear message to the market that the agenda of growth will continue to be a top priority moving forward. This development improved the confidence toward the political stability as well as the policy stability going forward. Election-related volatility has now reduced and India VIX is currently hovering around 13-14 levels, which stands far below its longterm average.

In the last one month, our benchmark index Nifty 50 went up by 6.6% while the broader market Midcap/Smallcaps went up by 8%/10% respectively. This outperformance was led by improved sentiments and positive flows. FIIs, who were the net sellers on a 3-month scale have turned into net buyers in the last one month. With this positive development, the Indian market cap has crossed the $5 Tn mark once again in June’24. Currently, 83% of the NSE 500 stocks were trading above their 200-DMA (day moving average) vs. the 60% of the stocks on the 4th June’24 closing. This indicates that the market has moved out of the oversold zone in the last one month.

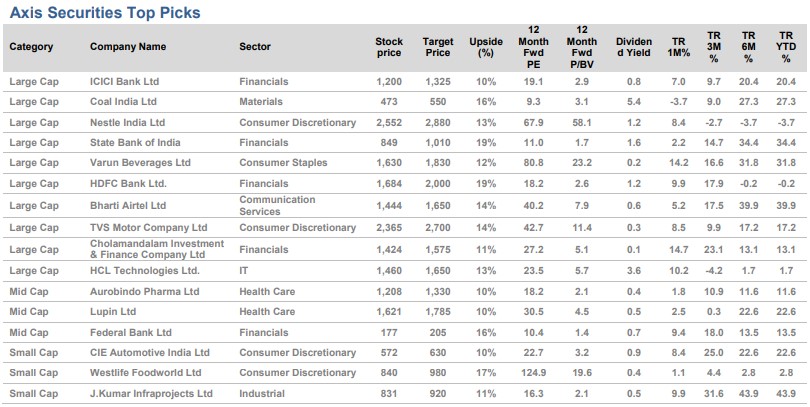

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank, Coal India, Nestle India, State Bank of India, HCL Tech, Lupin ltd, Aurobindo Pharma, Federal Bank, Varun Beverages, TVS Motors, Bharti Airtel, J Kumar Infra, CIE Automotive India, WestlifeFood world, and Cholamandalam Invest and Finance.