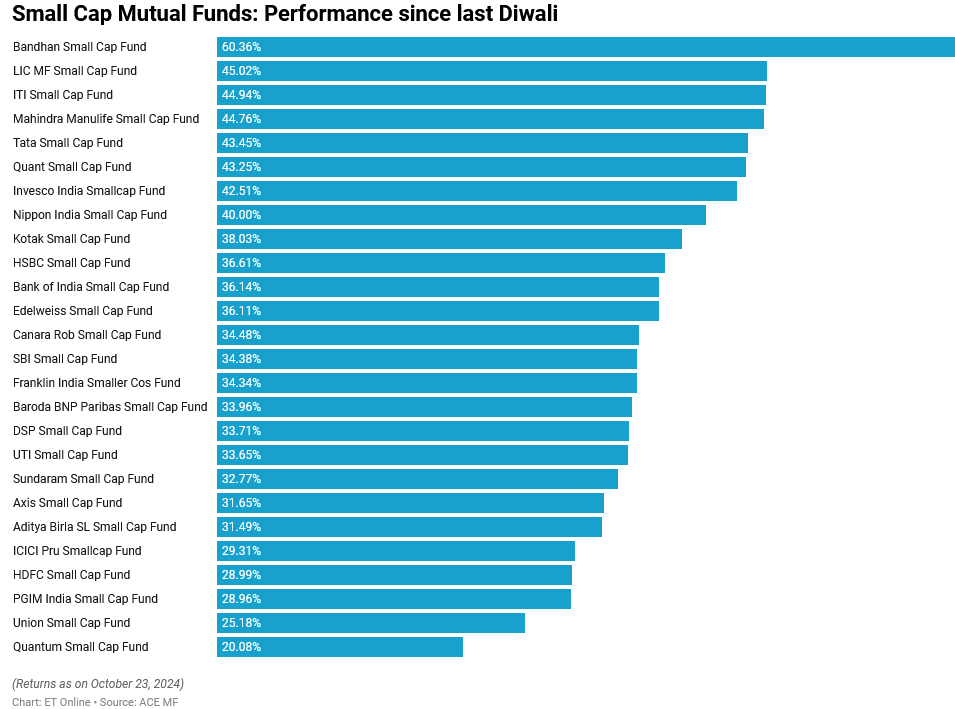

Bandhan Small Cap Fund is the topper in the small-cap category with a return of 60.36% since the last Diwali. LIC MF Small Cap Fund gave 45.02% return in the same period, followed by ITI Small Cap Fund which gave 44.94% return in the same horizon, ET Money stated in a report.

The average return from small cap mutual funds was around 36.31% since the last Diwali in November 2023. Around 26 small cap funds have been there in the market in the said period.

Tata Small Cap Fund and Quant Small Cap Fund gave 43.45% and 43.25% returns respectively since November 2023. Nippon India Small Cap Fund, the largest small cap fund, gave 40% return in the mentioned period.

The small cap schemes are benchmarked against Nifty Smallcap 250 – TRI and BSE 250 Small Cap – TRI which gained 38.20% and 38.24% respectively since the last Diwali.

Canara Rob Small Cap Fund and SBI Small Cap Fund offered 34.48% and 34.38% returns respectively. Franklin India Smaller Companies Fund delivered 34.34% return in the said period.

HDFC Small Cap Fund delivered 28.99% return since November 12, 2023. Union Small Cap Fund and Quantum Small Cap Fund delivered 25.18% and 20.08% returns respectively in the same period.

Experts say there is a lot of room to generate significant wealth in small caps, especially when there are a lot of startups or businesses that are up for listing. However, one must exercise caution while allocating assets and adhere to the asset allocation based on their risk tolerance.

Experts also cautioned that as small cap schemes invest in very small companies or their stocks, investing in small cap stocks is extremely risky. The small cap segment can be extremely volatile in the short term, but they have the potential to offer very high returns over a long period. Small cap schemes are recommended only to aggressive investors with a high-risk appetite and long investment horizon, say, around seven to 10 years.