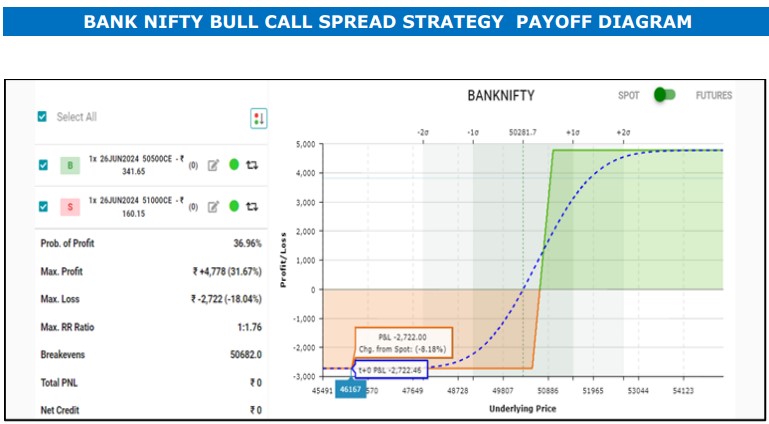

From the recent high, Bank Nifty has corrected more than 1000 points which we believe is a running correction in an overall uptrend. Bank Nifty has now reached near to support level of 51800-52000 levels. In the option segment we have seen put writing at 51500-52000 levels. We therefore believe Bank Nifty is likely to trend higher till 16 July 2024 expiry. We recommend a Bull Call Spread strategy in Bank Nifty to profit from this view.

Action to be taken

Buy 52200 Call @Rs 400 & Simultaneously Sell 52700 Call at Rs 192 (16-July Expiry).

Max Profit Rs 4380 If Bank Nifty closes at or above 52700 on 16-July Expiry.

Max Loss Rs 3120 If Bank Nifty closes at or below 52200 on 16-July Expiry.

Breakeven point: 52408

Risk Reward Ratio: 1:1.4

(Approximate margin payable for the strategy Rs.15700 (for exact margin, pls consult risk team email or check margin calculator on website)

Please note that the spread position may be exited early depending on the reading of the market.