When Basant Maheshwari of theequitydesk.com and ‘Basant Top Ten’ announced Page Industries as his number one stock pick, hard core value investors recoiled in horror.

“How can you buy a stock quoting at such an exorbitant valuation and sleep peacefully at night” they asked, their eyes rolling in indignation.

“Value investors” are hardwired to believe that the only stocks that are worth buying are those quoting at low valuations and where the “margin of safety” is high.

Page Industries would never come into the radar of a value investor because it has always, traditionally, quoted at exorbitant PE ratios of 40+.

However, Basant Maheshwari was not daunted. He looked value investors straight in the eye and quipped in his trademark fast style of speaking “the fact that a stock has gone up so much so fast does not mean it cannot go up further”.

Basant Maheshwari also coined a classical definition of what is a great business. He said “A great company is one that generates high return on capital, has got free cash-flow and over a period of time distributes that free cash flow as dividends for the shareholders”.

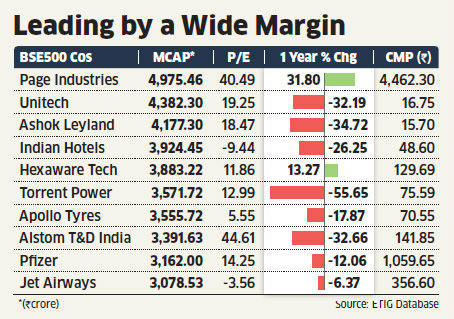

Now this confidence of Basant Maheshwari in Page Industries has paid off big time because the Economic Times has now reported that the market-cap of Page Industries has overtaken that of heavyweights like Jet Airways, Apollo Tyres and Indian Hotels.

The result: Investors who put faith in Page Industries have a huge multibagger sitting pretty in their portfolio.

The best part is that the long-term story of Page Industries is still intact. ET pointed out that the innerwear market in India is estimated at a gargantum Rs 25,000 crore and that it is expected to grow at 12% to 14% over the next decade. ET also pointed out that Page Industries’ management has expressed confidence of achieving 20% topline and bottomline growth in the next four to five years and that it is also planning to enhance its distribution network from the current 23,000 stores to 40,000 stores over the next four to five years.

Sadly, however, Basant Maheshwari’s other stock picks have not met with the same exuberant success.

Hawkins, Basant Maheshwari’s number two stock pick, is still struggling with the after-effects of the Pollution Control stay order and the labour unrest. The stock has lost about 16% in 3 months.

Titan, another of Basant Maheshwari’s favourite stocks (also Rakesh Jhunjhunwala’s crown jewel stock), has also been badgered after the RBI dealt a body blow to its business model. The stock is struggling to keep afloat on a YOY basis.

Even Gruh Finance, in whom Basant Maheshwari has pinned high hopes, is keeping a low profile owing to the hostile interest regime prevailing presently.

What remains to be seen is whether Basant Maheshwari’s other stock picks keep pace with Page Industries’ scorching performance on the bourses.

Basant Maheshwari is a seasoned investor. Given time most of his other picks will do well.