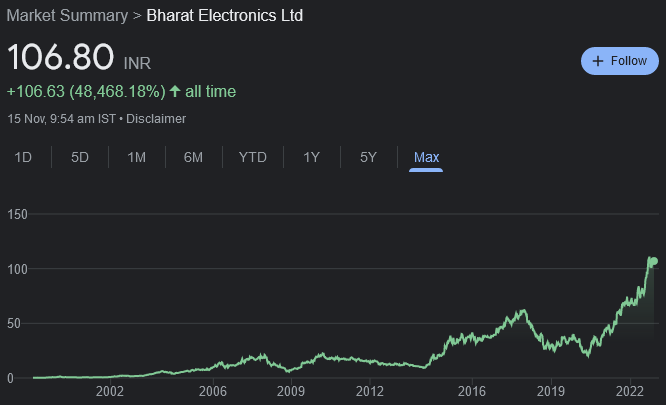

If I had bought 10% of BEL & USL in the 1990s, I would be a Forbes Billionaire today

In a YouTube talk of May 2010, Ramesh Damani lamented that the biggest regret of his life was the inability to think big. He pointed out that in the 1990s, he was very confident about Bharat Electronics and United Spirits and that he had the means to buy 10% of the equity capital of both companies.

However, by force of habit, he bought only a piddling quantity of both.

“The biggest failure of my life is in the inability to dream big. I would have had to do nothing else. Just two stocks would have made me a Forbes billionaire. You will never get seriously rich by buying 2,000 or 10,000 shares. When you get a seriously attractive opportunity, back up the truck with the stock” he said.

The biggest failure of my life is in the inability to dream big. Rakesh rose to the top because he could make huge outsized bets. He was not afraid. His ability to take that bet once he was convinced was truly extraordinary. I wished I had learnt from Jhunjhunwala: Ramesh Damani pic.twitter.com/fCcYBNzlCP

— RJ Stocks (@RakJhun) August 17, 2022

Be a Pig when conviction is high. Strike when the Iron is hot. Go for the Kill

Ramesh Damani repeated this valuable advice in his latest interview as well.

“Be a pig when conviction is high. The trick for me has always been to push myself to buy bigger positions. There is a saying on Wall Street that the bulls make money, the bears make money, but the pigs get slaughtered. But that’s not quite true. Because sometimes you need to be a pig in the market,” he said.

“You learn that when the iron is hot, you have to strike it and then go in for the kill,” he added.

(Ramesh Damani with son Ashok and grandchildren, Sonia Shenoy & Nimesh Shah)

BEL has gone from Rs 160 Cr to Rs 60000 Cr and can double even now

Ramesh again cited the example of Bharat Electronics for inspiration.

“It was a Rs 20 stock with a Rs 2 dividend built in and Rs 160 crore marketcap. Now it has Rs 60,000 crore marketcap and it could double from these prices too. So it has created long term wealth. The mistake people make often is to bunch FMCG stocks versus all PSU stocks,” he explained.